We have a saying in Filipino that says “nasa huli ang pagsisisi”. As a financial advisor in few years, I met a lot of people who regret not getting life insurance when they were young, healthy and have the capacity to pay. They realized the importance of life insurance until it’s too late already. They may no longer be insurable due to health reasons or they may no longer afford the premium.

We have a saying in Filipino that says “nasa huli ang pagsisisi”. As a financial advisor in few years, I met a lot of people who regret not getting life insurance when they were young, healthy and have the capacity to pay. They realized the importance of life insurance until it’s too late already. They may no longer be insurable due to health reasons or they may no longer afford the premium.

While You Were Young

People don’t know that as we get older our insurance premium becomes more expensive . This has something to do about mortality rates. A person in his 40s or 60s could pay twice the premium of a person in his 20s but with the same benefits. Imagine saving up to 50% of your premium if you just availed your life insurance policy when you were young.

While You Are Healthy

Get life insurance while you are still healthy because once you are diagnosed with a serious illness you may no longer be insurable and no insurance company will accept you even you have money to pay the premium. Some people have emailed me asking if they could avail our cheap critical illness for their cancer treatment. I told them that it is no longer possible because they are no longer healthy to pass our underwriting requirements. Even if they lie to a life insurance agent about their medical condition, their claim may be denied due to fraud or intentional misdeclaration of their medical condition. Insurance companies may also require medical exam or they will dig into your medical history to make sure that you are still insurable. Not all medical conditions are not insurable so it is best to consult an insurance advisor to know your options. There are health conditions that are still insurable but with additional premium/payment. Moreover if you have health condition before but no longer present now or had already been treated, you may apply for a life insurance and let the company decide whether to insure you are not.

While You Still Have the Capacity To Pay

Get a life insurance while you still have the capacity to pay. Our financial obligations change through time. Getting married, having kids and acquiring properties cause heavy financial responsibility. Thus, while you still have small financial obligations, get as much life insurance as possible so that by the time your financial obligations pile up, your policies are almost paid up. Young professionals in their 20s should get life insurance early on their career so that by the time they get married and have kids, they are almost done paying their life insurance policies.

Latest posts by Raymund Camat (see all)

- How To Become A Sun Life Financial Advisor - December 19, 2021

- Importance of Emergency Fund During a Pandemic (COVID-19) - March 18, 2020

- The Importance of Having an Emergency Fund - September 8, 2019

- Whole Life Critical Illness Insurance Plan – 100 Critical Illnesses Covered Up To Age 100 - September 8, 2019

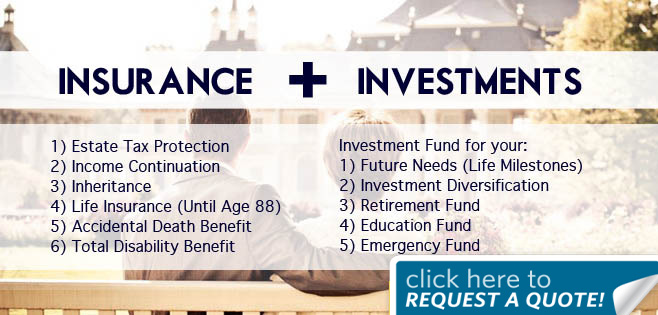

- Benefits of Having a Life Insurance Plan with Investment - September 8, 2019

Leave a Reply