We always pray and wish for good health for ourselves and our families because we believe that health is wealth. Indeed, health is wealth because if we get sick, we cannot work and earn money and our savings (wealth) will be spent for expensive medical treatments.

We always pray and wish for good health for ourselves and our families because we believe that health is wealth. Indeed, health is wealth because if we get sick, we cannot work and earn money and our savings (wealth) will be spent for expensive medical treatments.

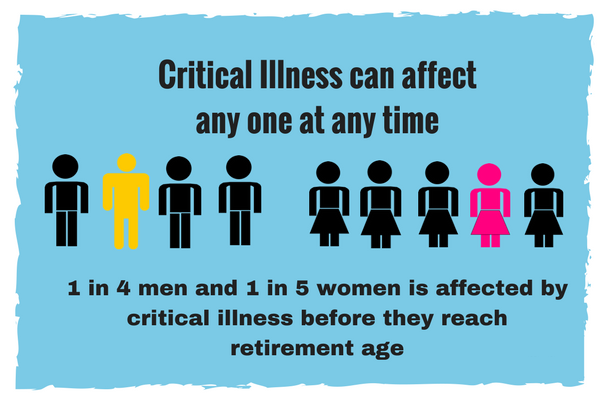

Unfortunately, sickness or illness is a natural part of life and there are many unfortunate people who get sick unexpectedly. Illness can wreck havoc to our financial stability so it is best to be prepared financially when it strikes us. Health insurance is a great financial defender against illness especially critical illnesses which require big amount of money for medical treatments and medicines.

LIST OF CRITICAL ILLNESSES

1. Heart Attack

2. Stroke

3. Cancer

4. Kidney Failure

5. Dissecting Aortic Aneurysm

6. End Stage Lung Disease

7. Progressive Muscular Atrophy

8. Major Burns

9. Multiple Sclerosis

10. Paralysis

11. Total Blindness

12. Loss of Limbs

13. Aplastic Anaemia

14. Bacterial Meningitis

15. Benign Brain Tumour

16. Deafness

17. Encephalitis

18. Amyotrophic Lateral Sclerosis (ALS)

21. Cerebral Metastasis

22. Loss of Speecch

23. Coma

24. Parkinson’s Disease

25. Terminal Illness

26. Medullary Cystic Disease

27. Alzheimer’s Disease

28. Fulminant Hepatitis

29. Major Head Trauma

30. End Stage Liver Failure

31. Motor Neurone Disease

32. Guillain-Barre Syndrome

LIST OF CRITICAL ILLNESSES REQUIRING SURGERY

33. Major Organ Transplant

34. Coronary Artery Bypass Surgery

35. Surgery for Disease of the Aorta (Aortic Surgery)

36. Replacement of Heart Valve

CRITICAL ILLNESS TERM INSURANCE: FINANCIAL DEFENSE AGAINST THESE 36 CRITICAL ILLNESSES

With the goal of giving each Filipino the opportunity to have financial protection against critical illnesses, the life insurance company I represent offer critical illness term insurance. It is a five-year renewable term plan that pays the face amount either upon death of the life insured or if life insured is diagnosed, while living, to have any of the 36 specified critical illnesses and, where applicable, has undergone any specified surgeries before the insured attains age 70.

How can this plan benefit policy holders? For example, If I am diagnosed today with invasive cancer while being plan holder of critical illness term insurance with face amount of 1 Million pesos, I will be able to claim 1 Million pesos benefit amount from the life insurance company.

I will file a claim to the company with the proper medical certificates and documents from my doctors or hospital. I will use the money for medical treatments and medicines. Where on earth can I get 1 million pesos for cancer treatment? Even banks and relatives could not lend me this amount of money.

Another example, If I am paralyzed today and have the same term insurance plan, my family will file a claim for 1 Million Pesos. Of course, I cannot file a claim myself if I am already paralyzed right? My family can use the money for my hospital expenses as well as medicines. They may even use it to hire somebody to take care of me, like a caregiver. This way, I will not cause too much burden to my family.

People with family history of cancer, heart diseases, stroke and other critical illnesses should seriously consider getting critical illness insurance for protection because they have higher chances (genetic predisposition) of developing these illnesses.

Healthy individuals should get too because life is very unpredictable.

IS IT EXPENSIVE?

I want you to be the one to judge it if it is expensive. Here is a sample proposal/quote for a 30 years old, male, non-smoker:

Annual Payment/Premium: 9,880 Pesos

Semiannual: 4,940 Pesos

Quarterly: 2,470

Monthly: 823

BENEFITS:

Face Amount: 1 Million Pesos – Money I will receive if I am diagnosed with the 36 critical illnesses. Same amount of money will be received by my beneficiaries after my death due to any reason. Whichever come first, death or critical illness, the life insurance company will pay.

Accidental Death Benefit (ADB) Rider: 1 Million Pesos as Accidental Death Benefit

Total Disability Benefit (TDB) Rider: I will not pay anymore in case of total and permanent disability (Waiver of premium)

*Lowest Face Amount is 500K with a premium amount of Php5,140 inclusive of the ADB and TDB riders. You have the option to not include the ADB and TDB riders but I highly encourage that you include them already to maximize the plan. The maximum Face Amount is 15Million Pesos.

Note: This plan is not available for OFWs for now. Read our regular pay VUL and limited pay VUL plans to know your options.

REQUEST A FREE PROPOSAL & APPOINTMENT

Latest posts by Raymund Camat (see all)

- How To Become A Sun Life Financial Advisor - December 19, 2021

- Importance of Emergency Fund During a Pandemic (COVID-19) - March 18, 2020

- The Importance of Having an Emergency Fund - September 8, 2019

- Whole Life Critical Illness Insurance Plan – 100 Critical Illnesses Covered Up To Age 100 - September 8, 2019

- Benefits of Having a Life Insurance Plan with Investment - September 8, 2019

Hi Raymund,

Thanks for this very good article, just wanted to ask please some clarifications:

1- for term insurance you mentioned an annual payment, how many years does this need to be paid? (I saw kase in your vul plan plan article it was for 10 years)

2- how soon can a beneficiary claim the for insurance after starting to pay the premiums? (I.e yung 1 million ba can be claimed say 6 months after magmonthly and holder tapos may nangyari sa kanya?) or there has to be a certain duration in paying the premiums? Thank you so much.

I answered your questions in our personal meeting Sir, Thank you for trusting me and Sun Life.