I noticed that many people are searching the top 10 life insurance companies in the Philippines. I guess, many of these searches are from ordinary Filipinos who are looking for the best life insurance companies to get their first life insurance policy. This is a clear indication that Filipinos are doing their research first before buying life insurance, after all life insurance is a financial product that would be important for them in the future. They would like to make sure that they are entrusting their future to a stable and credible life insurance company. I myself have life insurance policies from the top 5 life insurance companies in the Philippines. I trust and believe these companies that they will meet their obligations to my family once I leave this earth or become disabled.

I noticed that many people are searching the top 10 life insurance companies in the Philippines. I guess, many of these searches are from ordinary Filipinos who are looking for the best life insurance companies to get their first life insurance policy. This is a clear indication that Filipinos are doing their research first before buying life insurance, after all life insurance is a financial product that would be important for them in the future. They would like to make sure that they are entrusting their future to a stable and credible life insurance company. I myself have life insurance policies from the top 5 life insurance companies in the Philippines. I trust and believe these companies that they will meet their obligations to my family once I leave this earth or become disabled.

Although, it is highly recommended that you get your life insurance policy from the top 10 life insurers in the country, I can safely say that you can get your life insurance policy to any of the 31 life insurance companies authorized by the Insurance Commission to sell life insurance. The Insurance Commission strictly regulates these life insurance companies according to the Insurance Code of the Philippines to protect the public. This government agency makes sure that the insurance companies have enough reserve and capitalization to meet their obligations to their policyholders.

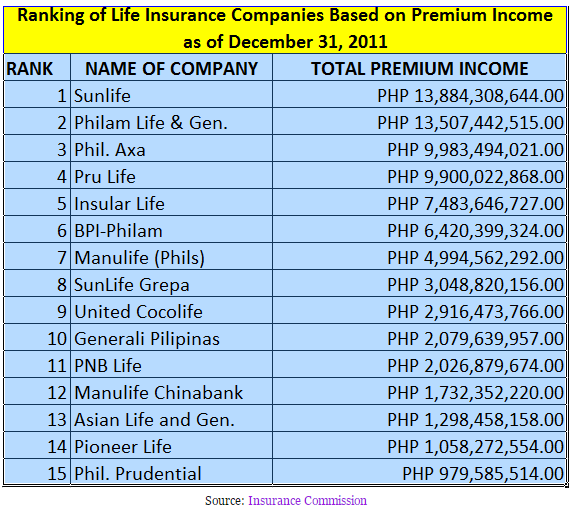

I was able to get a copy of the ranking of life insurance companies based on total premium income or premium collection. You will notice that the companies found in the top 5 are those with aggressive marketing campaigns in television, print media, radio, and internet. I think these marketing campaigns are great because more and more Filipinos would be able to learn the importance of life insurance.

If you like to see the complete list, visit this link. Take note that the insurance companies are also ranked according to assets, net worth, investment at cost, net income, and paid up capital. This is the reason why more than one life insurance companies claim to be number one. For current policy holders, if you do not see your company in the top 10, don’t worry because your policy contract is enforced as long as you pay your premiums. In the end, it is not about the ranking of the insurance company that matter but about the capability of the company to meet its obligations when the time comes.

For Filipinos without life insurance policy, you should get one now because you and your family needs it. Life insurance benefits could not only be enjoyed (by dependents) after the insured death, but can also be enjoyed while he/she is alive. Whole life, endowment, and variable universal policies have savings and investment features that you can use for your retirement, child education and future expenses. It is not too late to get insured, it’s time! You may request a life insurance proposal by filling up the form here (no obligations in your part). I will happily make a life insurance proposal that caters your need. Be insured now or never!

Update:

2012 Ranking of Life Insurance Companies based on Premium Income.

2014 Ranking of Life Insurance Companies based on Premium Income

Latest posts by Raymund Camat (see all)

- How To Become A Sun Life Financial Advisor - December 19, 2021

- Importance of Emergency Fund During a Pandemic (COVID-19) - March 18, 2020

- The Importance of Having an Emergency Fund - September 8, 2019

- Whole Life Critical Illness Insurance Plan – 100 Critical Illnesses Covered Up To Age 100 - September 8, 2019

- Benefits of Having a Life Insurance Plan with Investment - September 8, 2019

Hi Raymund,

My name is Mary Jane, an OFW. I am interested in investing in Mutual Fund but I am seeking for more helpful tips from financial adviser. Perhaps, you could be of help.

Hope to hear from you.

Regards,

Mary Jane

Hi, email your questions at raymund.camat@moneytalkph.com

Hi sir raymund, 40 yrs old na ako, last year lang ako nakakuha ng policy sa sunlife, 10 years to pay, and then kumuha yung husband ko sa manulife, 5 years to pay, bagong program yun ng manulife, sila na po ng anak ko ang insured dito, me narinig po kasi ako na nagkaproblema ang manulife, parang di totoo, kasi nasa top 10 naman sila, kung sakali puwede ko ba mabawi yung nasimulan namin sa manulife nagstart lang kami just last december 2014, thank you so much, God bless you and your family….

Hi Maam,

Beware of “hearsays” like that. I believe “chismis” lang yan. Manulife is going strong and one of the most stable life insurance companies in the Philippines. If you want to withdraw it, you will not get all your money because of the insurance charges applied. I strongly urge you not to cancel the plan because you are the one to lose not the one who told you that baseless hearsay.

Hi sir raymund camat, gusto ko lang po mag inquire gusto ko po kasi magkaroon po ng insurance habang ako po ay bata pa meron nadin po ng offer na saakin before kaso medyo natatakot lang po ako baka po kasi scam lang po.ngayon papano ko po malalaman kung talagang registered po talaga sya ng isang insurance life?at pano ko po masisigurado na hindi po maloloko? Yung last na ngooffer po sakin prulife po..

Thank you po sa reply.im jonathan r. 24years old seaman.

I want to know where is the Family First Insurance Company now or Dunvil ?

The policies issued by Danvil were bought by Philippine Prudential life. So Danvil policy holders are now under Philippine Prudential LIfe.