Many Filipinos who travel abroad today don’t purchase travel insurance before they depart. Travelers only buy travel insurance when it is required. Required or not, travel insurance is very important when traveling abroad. When you get sick or suffered injuries abroad, your travel insurance can cover your medical expenses. Your local travel insurance provider will coordinate with accredited hospitals where you will be confined. Take note that medical expenses abroad are very expensive and you may not afford it. Hospitals may even be hesitant to provide expensive medical treatment for you because of the fear that you may not pay. Bringing a travel insurance policy may convince hospitals abroad to provide the medical treatments you need. Travel insurance also cover legitimate baggage loss and delay, missed departures, death, disablement and repatriation of mortal remains upon death.

BPI/MS Insurance Corporation is one of the leading and most trusted provider of the best and affordable travel care insurance in the Philippines. It has very affordable packages with the following benefits:

Death or Disablement: BPI/MS pays benefit specified in the policy schedule for accidental death & disablement within 90 days from the date of the accident.

Medical and Additional Expense: Travel Care covers for medical, surgical or hospital charges and emergency dental treatment charges incurred as a result of accidental bodily injury, illness or death during your journey as specified in your policy schedule.

Loss of Baggage including Delays: Pays for actual or replacement cost of baggage due to accidental loss, theft or damage during the trip. This will also take care of your worries in case your checked-in baggage has been delayed, misdirected or misplaced in delivery for more than 8 hours from the time you arrive at your destination.

Trip Cancellation / Curtailment: Reimburses non-refundable expenses such as airline tickets, irrevocable deposits and advance payment for accommodations if your trip is cancelled or curtailed due to unforeseen incidents.

Missed travel Connections: Pays benefit up to a maximum of PHP 10,000 for reasonable additional travel and accommodation costs incurred in the arrangement of alternative travel.

Hospital Cash Benefits: Pays a fixed amount of PHP 1,000 for each day that you are hospitalized as an inpatient due to accident or illness up to a maximum amount of PHP 10,000.

Personal Liability: Travel Care covers expenses that you might incur if you caused another person’s accidental death, bodily injury or damage to property, resulting from accidents.

Delayed Departure: This feature is an added benefit, which reimburses up to PHP 10,000 for incurred expenses if your flight is delayed by more than 8 hours.

Missed Departure: Pays for additional travel expenses and accommodation costs up to a maximum amount of PHP 10,000 for incurred expenses if your flight is delayed by more than 8 hours.

Loss of Passport: Pays for reasonable costs of additional hotel, travel and communication expenses necessary in obtaining replacement for a lost passport or visa up to a maximum amount of PHP 10,000.

Hijack: This added benefit would provide you a fixed amount of PHP 5,000 for each day that your travel is delayed due to organized industrial action or hijack.

Rental Vehicle Excess Cover: Reimburses excess liability up to PHP 10,000 if you become legally liable provided that accidental loss or damage to the vehicle was caused by collision or theft while it is in your custody.

Additional Costs of Rental Car Return: Pays costs up to PHP 5,000 for car rental if you are unable to return any rental vehicle due to accident or illness.

Extension of Period of Journey: This feature is automatically FREE of charge if the journey is extended due to public transport delay or bodily injury or sickness up to:

- 7 days delay for the carrier

30 days delay if due to injury or illness

Emergency Medical Evacuation: Arranges and pays for covered expenses incurred if your medical condition needs immediate transportation, from the place where you are to the nearest hospital, where appropriate medical treatment can be obtained.

Emergency Medical Repatriation: Arranges and pays for covered expenses incurred if your medical condition needs transportation to your home country to obtain further medical treatment or to recover.

Transportation of Mortal Remains: Arranges and pays for all reasonable expenses incurred for the preparation and return of your mortal remains to your home country.

Emergency Telephone Expenses: Pays for the telephone expenses accumulated for calling the Emergency Hotline (i.e. 911), during accidents or illness up to a maximum amount of PHP 2,000.

Free 24-Hour Worldwide Travel Assistance Services: Through our service provider, INTERNATIONAL SOS, BPI/MS will arrange the following emergency assistance benefits when you call the Travel Care hotline at (632) 687-8535.

Travel Assistance

Pre-Trip Information Services

Embassy Referral

Lost Luggage Assistance

Lost Passport Assistance

Weather and Exchange Rate Information Assistance

Emergency Message Transmission Assistance

Interpreter Referral

Medical Assistance

Telephone Medical Advice

Medical Service Provider Referral

Arrangement of Appointments with Local Doctors for Treatment

Arrangement of Hospital Admission and Monitoring of Medical Conditions When Hospitalized

Dispatch of Essential Medicine

Arrangement of Compassionate Visit

Arrangement of Returns of Minor Children

Arrangement of Hotel Accommodation

Commencement & Expiry: The term of coverage commences two (2) hours before your scheduled departure time and ceases on whichever of the following occurs first:

a. the expiry of the policy period specified in the policy

b. your return to your residence or employment

c. within two (2) hours after scheduled time of arrival

Exclusions:

The policy shall not be answerable for any medical, surgical, hospital or other contingent expenses, including death benefits relating to the following:

a) Any pre-existing condition, sickness, disease or ailment manifesting in the Insured Person twelve (12) months prior to covered period of travel as stated in this policy schedule, including but not limited to hypertension, cancer of any form, heart disease, pulmonary disease, renal disease, epilepsy, mental or nervous disorders, diabetes, asthma, scoliosis, arthritis, visual and/or hearing impairment

b) any outbreak of any epidemic or pandemic sickness, virus or disease as such, but not limited to, Severe Acute Respiratory Syndrome (SARS), Avian flu, A (H1n1) and the like

c) any accident or injury to the Insured Person occurring while engaged in an organized sport competition of any kind, undertaken on a professional or sponsored basis

d) any addiction or abuse of any form or narcotic, drug or medication

e) any injury or death resulting from the Insured Person’s practice or utilization, either as a pilot or passenger, or a sailplane, hanglider, parasail, parachute, or engaging in any aerial flight other than as passenger

f) any injury or death as a result of scuba diving, wake boarding, water skiing, jet skiing, bungee jumping, rock climbing.

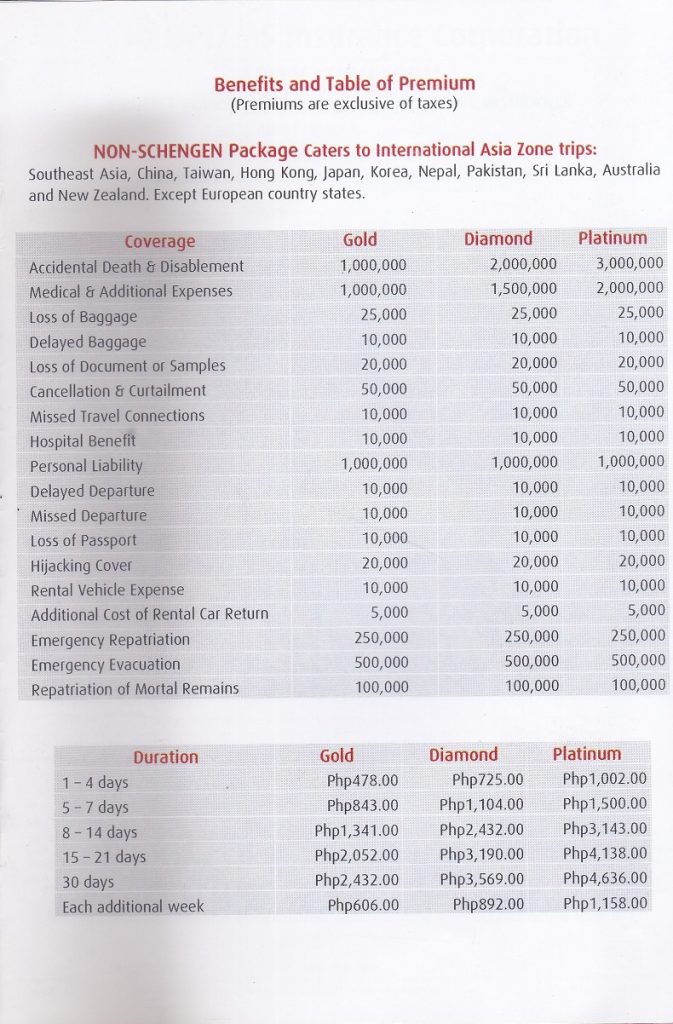

NON-SCHENGEN TRAVEL INSURANCE

Non-schengen countries are countries outside the European Union which include Japan, Korea, Canada, USA, Middle Eastern Countries, Singapore, Hong Kong, Taiwan, China, Malaysia, Indonesia, Vietnam, Thailand, India, African countries, Central and South American countries and others. Travel insurance may not be required in getting tourist visa in these countries but for your own protection you should voluntary get travel insurance before you go to these countries.

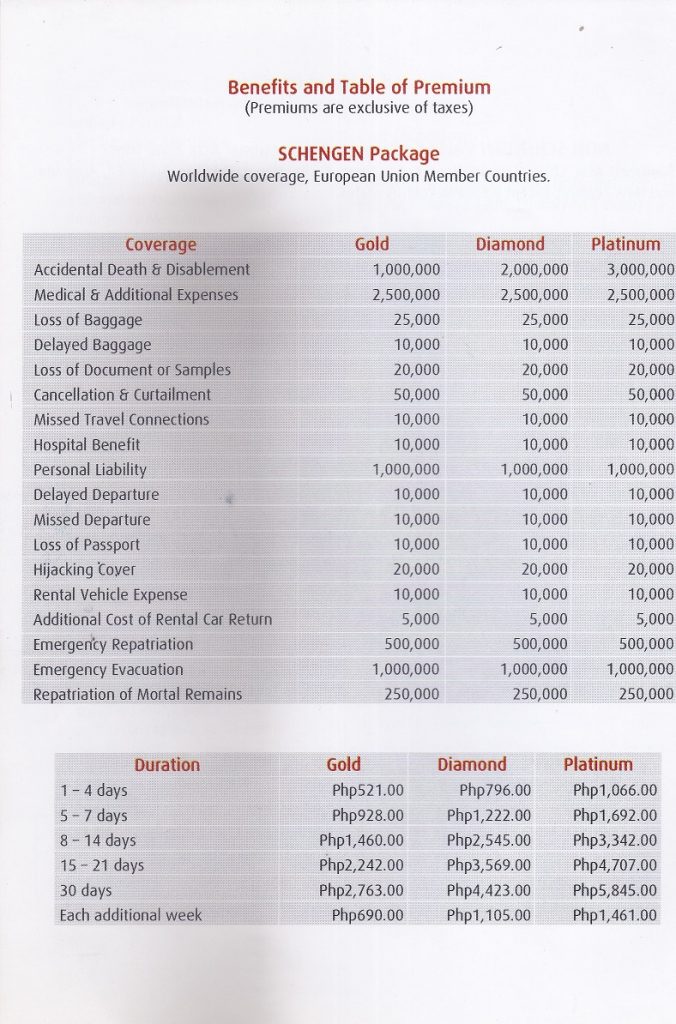

SCHENGEN TRAVEL INSURANCE

Travel insurance is a mandatory requirement when applying for a tourist visa to any of the countries in the European Union. The European Union requires a minimum of 30,000 Euros or about 1.6 Million Philippine pesos coverage so get at least the diamond plan below.

Latest posts by Raymund Camat (see all)

- How To Become A Sun Life Financial Advisor - December 19, 2021

- Importance of Emergency Fund During a Pandemic (COVID-19) - March 18, 2020

- The Importance of Having an Emergency Fund - September 8, 2019

- Whole Life Critical Illness Insurance Plan – 100 Critical Illnesses Covered Up To Age 100 - September 8, 2019

- Benefits of Having a Life Insurance Plan with Investment - September 8, 2019

Leave a Reply