Whenever I do financial planning to my clients, I always discuss the importance of building an emergency fund, which is the money set aside to cover emergencies or life’s unexpected events such as unemployment, medical expenses, home repairs, natural disasters, vehicle repairs etc. The fund should easily be accessible, meaning it can be withdrawn from the bank or kept at home. The recommended amount for emergency fund is at least 3 months worth of expenses. For me, the ideal is 6 months to 1 year worth of expenses.

Whenever I do financial planning to my clients, I always discuss the importance of building an emergency fund, which is the money set aside to cover emergencies or life’s unexpected events such as unemployment, medical expenses, home repairs, natural disasters, vehicle repairs etc. The fund should easily be accessible, meaning it can be withdrawn from the bank or kept at home. The recommended amount for emergency fund is at least 3 months worth of expenses. For me, the ideal is 6 months to 1 year worth of expenses.

It surprises me that many of our fellow Filipinos don’t have emergency funds. Their emergency fund is their credit cards, money borrowed from friends/relatives, money from loan sharks (5-6 loans), etc. Borrowing money for emergencies is not an ideal practice because of the big interest rates. It also destroy relationships when you borrow from friends/relatives then you did not pay the loaned money back.

When a person becomes unemployed, it may take few months before he could find another job. Of course, bills don’t stop coming in when a person becomes unemployed. With adequate emergency fund, his bills and other expenses will be paid up until he finds a new job.

Many Filipino families commonly face medical emergencies and majority of them do not have money set aside to cover the expenses. Borrowing money is inevitable; finding people to lend money is another problem. With adequate emergency fund, medical expenses could be easily covered and no need to borrow money from other people. It is a painful reality that many hospitals require downpayment before they will admit a patient. With no money, where do a sick person go? Many sick people in the Philippines die before they even meet a doctor or admitted in a medical facility. It is really sad to hear stories of sick people dying because they do not have money to pay medical expenses.

I am the type of person who cannot sleep at night when my emergency fund go below a minimum level. I fear that an emergency could happen anytime and as the bread winner of the family I am obliged to pay the expenses. I always feel that I should have enough money to cover unexpected expenses.

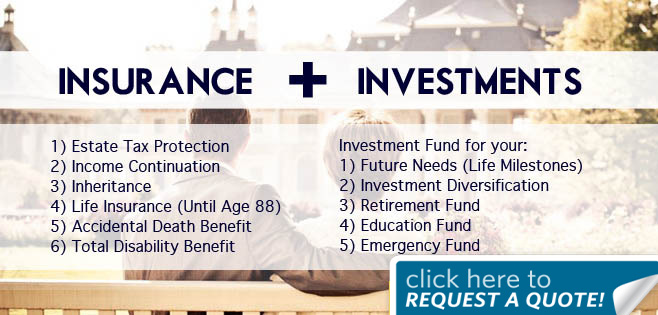

I always tell my clients that before they get an investment or insurance plan, they should have at least an emergency fund. Without an adequate emergency fund, they will sacrifice their investment or insurance plan when they face a financial emergency. They will be forced to prematurely sell their investments at a loss or they will be forced to surrender their life insurance policies resulting to loss of coverage. When clients surrender their life insurance policies, they would not only lose coverage but also they will not get all their money back because of the insurance fees collected by the insurance company.

Start building your emergency fund today. If you already have an emergency fund, I recommend you even increase it to cover more months. I suggest you have a separate bank account to put your emergency fund. Do not mix it up to your regular bank account. Also, with will power, fight the temptation to use your emergency fund to pay for unnecessary things. Remember that your emergency fund is intended for emergencies only. Using it for travel expenses and mall shopping is a big NO!

Latest posts by Raymund Camat (see all)

- How To Become A Sun Life Financial Advisor - December 19, 2021

- Importance of Emergency Fund During a Pandemic (COVID-19) - March 18, 2020

- The Importance of Having an Emergency Fund - September 8, 2019

- Whole Life Critical Illness Insurance Plan – 100 Critical Illnesses Covered Up To Age 100 - September 8, 2019

- Benefits of Having a Life Insurance Plan with Investment - September 8, 2019

Leave a Reply