With many life insurance companies in the Philippines right now and with the long list of life insurance plans they are offering, it is not uncommon for an average Filipino to get confused or undecided of which plan to get. It is as difficult as shopping clothes in a large department store.

Well, as a life insurance policy holder for many years, I still ask myself if I have availed the right or even the best life insurance policy in the market. Since life insurance is an integral aspect of my financial life and to my beneficiaries’ life, I want to have the best life insurance plan and I know many Filipinos out there who are planning to get their first life insurance are having the same concern.

If you are one of these Filipinos, I want to introduce to you this 10 year limited pay variable universal life (VUL) plan, an investment-linked life insurance plan which I think one of the best value for money insurance products offered by my life insurance company. (Disclaimer: I am a financial advisor). My wife and I are proud policy holders of this VUL plan because we believe on this product and its many benefits.

This life insurance plan is a variable unit-linked life insurance plan or commonly called VUL plan. In this plan, a portion of your premium or payment will be used to pay the life insurance fees and another portion will be invested into an investment fund (similar to mutual fund) of your choice: equity fund, bond fund, balanced fund, money market fund, index fund, etc.

In other words, this VUL plan will provide you life insurance coverage and investment fund. If you have this plan, my life insurance company will give your beneficiaries death benefit in case you die. The death benefit is 200% of the face amount of your policy. So if the face amount of your plan is 500,000 pesos, your beneficiaries will receive 1 million pesos if you die too soon (huwag naman sana).

Like what I said earlier, part of your money is also invested to grow which you can use to finance future needs like education of your children, retirement needs, travel expenses, business capital or emergencies. Aya Laraya of Pesos and Sense will help you understand VUL further by watching this video:

THE BENEFITS

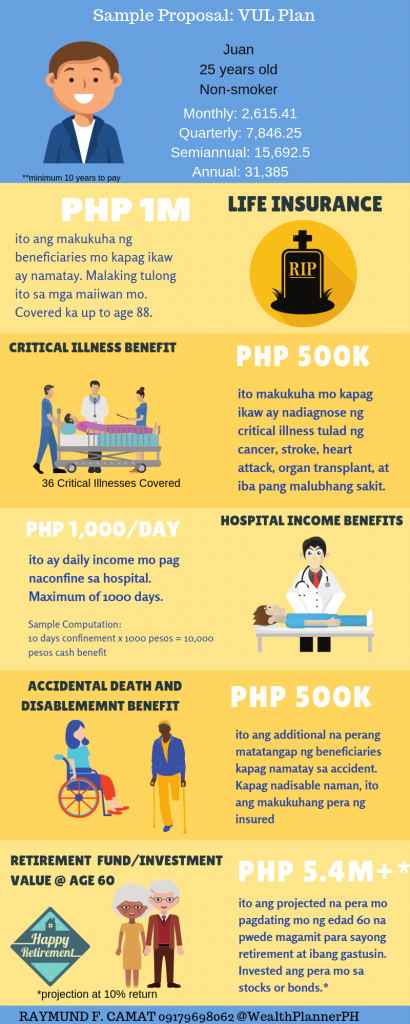

I want to show you the proposal I made when I got my VUL plan (10 Years To Pay, proposal generated year 2012):

Raymund F. Camat, Male, 25 years old, non smoker

Annual Payment: Php 31,385

Semiannual: Php 15,692.5

Quarter: Php 7,846.25

Monthly: Php 2615.41

Daily: Php 87.18

I preferred the semiannual payment method for financial reasons but policy holders can choose to pay quarterly, semiannual, annual or even monthly via autodebit (BDO or BPI). There is no additional charge if you pay in quarter, semiannual or monthly mode. The first payment however should be at least a quarter of the annual payment as required by the company. Let’s go to the benefits:

BENEFITS

- My family or beneficiaries will receive from the life insurance company 1 Million pesos when I die (200% of face amount 500,000 pesos) plus the accumulated investments or fund value of the policy

- I attached the Total Disability Rider (TDB) in the basic plan so that my payments are waived if I become totally disabled during the paying period of 10 years. I don’t need to pay if I am totally disabled. (Certain exclusions apply)

- I also attached the ADDD rider or the Accidental Death, Dismemberment and Disablement rider so that my family will get additional 500,000 pesos if I die due to accident; I will get up to 500,000 pesos dismemberment benefits if I lost certain body parts due to accidental injury; I will get disablement benefits of up to 500,000 pesos if I become totally disabled. (Certain exclusions apply)

- I also attached the Critical Illness Rider (CIB) so that I can claim up to 500,000 pesos for medical treatment if I am diagnosed of any of the 36 critical illnesses identified by the life insurance company including cancer, heart attack, stroke, paralysis, loss of limbs, terminal illness, kidney failure, aortic aneurysm, total blindness and deafness, and among others. Major organ bypass, coronary artery bypass, heart valve replacement and surgery of the disease of the aorta are also covered. Mind you, these critical illnesses are very expensive and can easily wreck havoc to my family’s finances so it is very important to have this additional benefit. Expenses for critical illnesses can easily wipe out your entire savings and investments. (Certain exclusions apply)

- Another rider I attached to my VUL Plan is the Hospital Income Benefit (HIB) rider which gives me daily income when hospitalized. If I availed this rider, I can get up to 1000 pesos a day when hospitalized for a maximum of 1000 days. It is just like a replacement of my daily salary when I get confined. The amount will be doubled to 2000/day if I will be confined in the ICU or be hospitalized due to acute heart attack, chronic liver disease, dissecting aortic aneurysm, end stage lung disease, end stage renal disease, invasive cancer, major organ transplant, multiple sclerosis, poliomyelitis, progressive muscular atrophy and stroke. (Certain exclusions apply)

If you don’t want the dismemberment or disablement benefits, you have the option to get the ADB or accidental death benefit rider only. I chose the ADDD rider because it has more benefits – a way to maximize the plan; I don’t mind paying higher premium.

Actually, I can get higher plans (Face Amounts: 1 Million, 2 Million and so on) but right now the 500K face amount is what I can afford. I can always get another plan naman or just put extra premium on top of my regular premium as to increase the fund value or life insurance coverage.

INVESTMENT

What I liked most about my VUL plan is its investment feature in which part of the money I pay regularly for 10 years is invested to an equity fund that is professionally managed by our company’s fund managers. If I don’t touch the money until retirement, I have the potential to become a millionaire retiree.

I know SSS will not make me a millionaire retiree so my VUL plan gives me a sense of excitement and assurance. Like everybody else, I want to retire comfortably – having food in the table, cash for utility bills, medical bills and even extra cash for travel and leisure activities. I don’t want to retire poor or dependent to my children or relatives. I want to retire rich and financially independent.

Here are the projected fund values/investment values at age 60:

Php 620,288 at 4% projected fund performance

Php 2,743,682 at 8% projected fund performance

Php 5,404,407 at 10% projected fund performance

Fund performance is the average annual compounded return which can be below 4% or even higher than 10%; the higher the percentage return, the higher return your money gets. The company is not allowed to project beyond 10% because of a directive from the Insurance Commission. Insurance companies should only project realistic returns. Take note also that the returns are not guaranteed and past performance of the investment funds are not indicative of future returns.

I think Php 5.4 million at age 60 is not a bad retirement fund, isn’t it? Of course I also have other life insurance plans with fund values or cash values and I have a mutual fund account from my life insurance company also. I think for someone who will work for almost 3-4 decades deserve a comfortable and prosperous retirement, right? I am obnoxious with the idea of being dependent to relatives financially in the future so I start saving and investing now.

Going back to my VUL plan, I can withdraw money against my fund value within or after the paying years without the need of paying it back or paying any interest as long as the fund value does not equal to zero. The good thing about this plan is that as long as the fund value does not equal to zero, the policy is still in-forced which means I am still insured with the face amount and the attached riders. But if my goal is to make the plan my retirement plan, I will not touch it until retirement age. If my child needs money for college, I can touch it if there are no other sources of fund in the future.

My VUL plan can be a good educational/college fund too especially if you get as early as your child is born. After 16-18 years, the fund value can help finance your child’s college education.

For Our Modern Heroes: OFWs

You can avail this plan even if you are working abroad, you need to be at least in the Philippines to sign the needed documents and also to be personally interviewed by your chosen Financial Advisor. Good news! Previously we don’t offer critical illness, hospital income and disability riders/benefits to most OFWs, but now my life insurance company open these wonderful benefits to OFWs with the exclusion of certain countries.

Ang ganda ng VUL plan di ba? Set an appointment now. You can also text/call me at 09179698062 (Phone/Viber) or email me at raymund.camat@moneytalkph.com. (For privacy and copyright reasons, I cannot show you actual proposal and specific details here so the best thing to do is schedule an appointment with me.)

SET APPOINTMENT / REQUEST PROPOSAL NOW

I can help you open your VUL Plan. Request a proposal now and set an appointment with me. It will be a privilege to serve you.

When you set an appointment with me, you have NO obligation or commitment to buy from our company. If you don’t like it, it is perfectly okey. The appointment is free and fun. I am available most of the time 24/7. You want a 3am meeting? No problem with me! Whether you are working in the morning shift, middle shift or night shift, I will find time for you.

The meeting will usually take 1 hour or less, or longer if you want to learn more or if you have questions. Since I am a full time financial advisor, I could adjust my schedule based on your location and working hours. I make it easy for you.

I serve clients in the following areas: Metro Manila, Rizal, Laguna, Batangas, Bulacan, Pampanga, Tarlac, Pangasinan, La union and Ilocos Sur. Clients not located in these places will be referred to licensed advisors near them.

Latest posts by Raymund Camat (see all)

- How To Become A Sun Life Financial Advisor - December 19, 2021

- Importance of Emergency Fund During a Pandemic (COVID-19) - March 18, 2020

- The Importance of Having an Emergency Fund - September 8, 2019

- Whole Life Critical Illness Insurance Plan – 100 Critical Illnesses Covered Up To Age 100 - September 8, 2019

- Benefits of Having a Life Insurance Plan with Investment - September 8, 2019

Leave a Reply