People who have accumulated wealth over their lifetime must plan ahead on how to properly distribute their wealth to their heirs after their death. This type of planning is called estate planning, which is defined as the “the collection of preparation tasks that serve to manage an individual’s asset base in the event of their incapacitation or death, including the bequest of assets to heirs and the settlement of estate taxes. (Investopedia)” Payment of estate taxes is the most important part of estate planning. After death, heirs must pay the estate tax to the BIR within 6 months, if not, the estate tax will be computed with 25% surcharge and 20% interest per year. The BIR said all real properties of deceased persons whose inheritance taxes have not yet been paid by their heirs can be foreclosed and sold through public auction and their cash in banks and jewelry can be garnished in favor of the government.

You read it right, the government can take over a deceased Pinoy’s property if the heirs will not pay the required estate tax.Estate tax payment is needed when heirs want to transfer house, land, shares of stocks and business interest to their names. We all know that tax collection is the absolute power of the government and we cannot do anything about it.

Before the heirs can withdraw the deceased person’s money in the bank, they need clearance from the BIR. (Update: With the new TRAIN law (Republic Act (RA) 10963) implemented in 2018, withdrawal is allowed but subject to 6% final withholding tax)

The maximum estate tax payment is 1.215 Million pesos for 10 Million pesos plus 20% on excess of 10 Million pesos (see the estate tax table here). So if a deceased person has 100 Million pesos estate, the tax is 19.215 Million pesos or almost 20 Million pesos (20% of estate). It is normal for heirs to complain with this huge tax obligation just like how employees complain up to 32% tax on their compensation. To reduce tax, parents sometimes donate their properties to their children (heirs) so that they will only pay the donor’s tax which is up to 15% of the market value of the assets. Parents also “sell” their properties to their children so that they only pay 7.5% sales tax. (Update: With the implementation of the TRAIN law last 2018, the estate tax is just 6% flat rate. I hope with . this new tax rate, many will pay their estate tax obligations)

Donating and selling as means of transferring properties give parents the idea that they saved money from paying estate tax. However, unfortunate consequence may arise when parents sell or donate their properties to their children/heirs . In the videos below, estate planning experts Atty. Angelo Cabrera and Sun Life-AIM Advisor Ruzette Cadungog said that parents may lose control over their assets and children if they donate or sell their properties to them. Once parents, sold or donated their properties to their children, they absolutely lost their legal rights to these properties. Practically, their children (and their spouses) can do whatever they want to their properties. Imagine, parents worked hard to accumulate their assets over time and all of a sudden, they no longer control it.

Parents believe that even though they sold/donated their properties to their children, they will still be in control over their properties and their children love them so much that they will not betray them in any way possible. I still believe that majority of Filipino children love their parents so much and they will not do anything to hurt their parents, like removing their parents’ rights to their properties. But there are real life instances that other parents should learn first before they sell or donate their properties to their children.

According to Miss Ruzette Cadungog, she has married clients before who transferred their 6 houses to their children equally, probably via donation in order to avoid paying estate tax. Years after, the father got sick and needed money for treatment. Unfortunately none of the children would like to volunteer selling one of their houses to help their father. They could be pointing fingers who should sell the properties. The daughters-in-law or sons-in-law already have interest over the properties and may have convinced their husbands or wives not to sell their properties. Of course, the married couple no longer have legal rights over the properties they donated to their children so they have nothing else to do besides convincing their children to give them money for treatment or sell their properties to make money for treatment. It appears like the parents are under the mercy of their children and their in-laws.

There is one story in which parents transferred the title of their house and lot to their only son while they are still alive. The reason might be to avoid estate tax or maybe they just love him very much. Years after, their son got married and had children. Unfortunately, the son died making his wife and his children the legitimate heirs. When the widow decided to leave and sell the house, the couple was shocked. Well, the couple has the option to buy the house back but what if they don’t have the money to be able to purchase it. Once the house is sold to other people, they are required by law to vacate the house they built using their hard-earned money. They asked legal advice from a lawyer but as expected he told them the hurtful truth that they no longer have any control over their property. Many say that the daughter-in-law is a bad person for doing that but we should understand where she is coming from. She may be a young widow with children without any significant inheritance from her husband besides the house. She needed the money for her children’s education and for daily living.

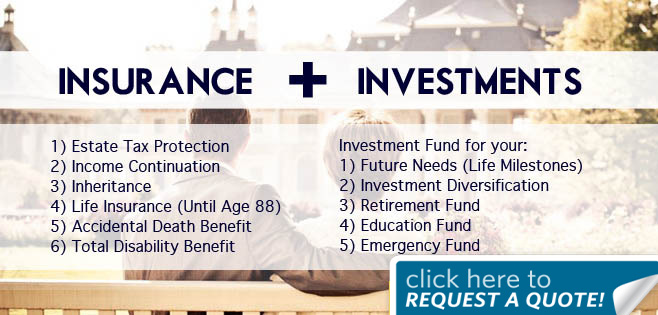

Life Insurance Proceeds to Pay Estate Tax

To prevent the unfortunate scenarios mentioned above, parents should get a life insurance plan that will pay the estate tax after their death. This way, parents would not worry about estate tax after their death because the proceeds from their life insurance policies will cover it. They will no longer resort on selling or donating their properties to their children to reduce tax. As long as they are alive, they enjoy and in full control over their properties.

Let us take an example. A father wants to know how much life insurance coverage he needs to cover the estate tax of his assets worth 50 Million pesos. The estate tax is estimated to be 3 Million (6% x 50,000,000).

The 50 years old father can get a term insurance plan with a death benefit coverage of 3 Million pesos. Term insurance is cheaper than other types of insurance such as whole life insurance or variable life insurance. It is a pure insurance plan in which it has no savings, investment or return of premium paid. Sun Life has a term life insurance product called Sun Safer life in which the death benefit is 200% of the face amount. The father can get a Sun Safer Life plan with 1.5 Million face amount with death benefit of 3 Million pesos.

The beneficiaries of the insurance policy should be assigned as irrevocable (not revocable) so that the death claim proceeds will not be subjected to estate tax like the other properties. The irrevocable beneficiaries, upon the death of the insured, will file a death claim to Sun Life. After the approval of the claim, the beneficiaries will receive the check that will be used to pay the estate tax. Once estate tax is paid, BIR will provide clearance to the heirs of the father’s properties. They can then divide the properties according to the last will and testament of their father or according to applicable laws in the absence of any will.

The life insurance proceeds saved the heirs of the burden of paying 3 Million pesos of estate tax. Without the death claim proceeds, the heirs have 6 months to produce the money to pay the estate tax or else they will be penalised with surcharge and interest. Worst case scenario, the heirs do not have money to pay the estate tax and the properties are in danger of being foreclosed in favor of the government.

If you want to learn more about the importance of life insurance in estate planning, do not hesitate to contact me.

Latest posts by Raymund Camat (see all)

- How To Become A Sun Life Financial Advisor - December 19, 2021

- Importance of Emergency Fund During a Pandemic (COVID-19) - March 18, 2020

- The Importance of Having an Emergency Fund - September 8, 2019

- Whole Life Critical Illness Insurance Plan – 100 Critical Illnesses Covered Up To Age 100 - September 8, 2019

- Benefits of Having a Life Insurance Plan with Investment - September 8, 2019

Is it true that there is a new rule that proceeds of a life insurance contract will not be subject to tax even if the beneficiaries are “revocable”? Please verify.

Thanks

From the insurance code of the Philippines: “SEC. 11. The insured shall have the right to change the beneficiary he designated in the policy, unless he has expressly waived this right in said policy. Notwithstanding the foregoing, in the event the insured does not change the beneficiary during his lifetime, the designation shall be deemed irrevocable.

Is it true that if you assign a revocable beneficiary in your life insurance it will automatically change to irrevocable beneficiary after 20 years?

While the is such provision in the amended Insurance Code, it does not and cannot overwrite the provisions in the tax code under Section 85 paragraph E that states that proceeds of life insurance are taxable except when EXPRESSLY STIPULATED that the beneficiary is designated as IRREVOCABLE.

Thank you Attorney for the input.

If the policy owner (not the policy insured) dies, will the policy be subjected to the policy owner’s estate tax?