My first exposure with insurance was when I was in college wherein we were required to get a personal accident insurance with a face amount of Php50,000 for a fifty pesos a year premium. Whenever we go to a field work outside our campus, our professors would require us to secure personal accident insurance first. The university strictly imposed no insurance, no field work policy. Although fifty thousand pesos is not a big amount, I know it will greatly help my family if ever I got an accident; we don’t really know what will happen outside.

One day, I met this lady life insurance agent who introduced me to the world of life insurance. I was surprised that I can possibly insure myself with millions of pesos, a big amount that will greatly help my family if ever I die or permanently disabled. But since I was a student at that time with small allowance from my parents and government scholarship, I don’t have the means to buy life insurance even though I really want to get one for myself. I even doubt if I will be able to get life insurance for myself since I was just a student and not earning money. I love the idea of giving back to my parents after all the years of taking good care of me. I promised myself that when the time comes that I will be employed, I will buy myself a life insurance that will help secure my plans for my family.

Luckily, after one year of working, my officemate introduced me to his friend and college batch mate, a young life insurance agent who offered me a whole life insurance plan. It was a perfect time to get a life insurance since I am already earning money being an employee. The agent and I were both 22 years old at the time. The agent was even shocked because I don’t have any objections but only few questions. I told him that unlike many Filipinos, young or old, I know the value of having a life insurance. I know me and my family need this life insurance in the future. Below are some of the reasons why I bought a life insurance policy and could be you reasons too:

– To help ensure that my sisters will finish college. My parents rely on me for the college education of my three sisters. Since my parents are just farmers, their financial capability of sending my sisters to college is limited so I need to help them out. My parents sacrificed a lot for my own education so that I will be able to help them send my sisters in school. The proceeds of my life insurance (when I die) will finance their college education. I really don’t know what will happen to the lives of my sisters if they will not finish college. These days, it is really difficult to find a decent job/earning without a college degree.

– To leave something for my parents too. My parents are also beneficiaries to my life insurance. I want to leave something for them so that they can move on with their lives even when I am already gone in this world. I know the emotional pain is there but at least with financial help I can help ease that.

– As saving for retirement and emergencies. The life insurance plan that I got has a savings component which forced me to save (which is good). After few years of paying, I can actually borrow to the available cash values of my plan to use for emergencies. If I don’t touch the cash values of my plan, it will grow and can be used as additional retirement fund in my retirement years. The plan is also eligible to earn dividends from the company, so besides from the guaranteed cash values, I will also receive dividends which will accumulate over time.

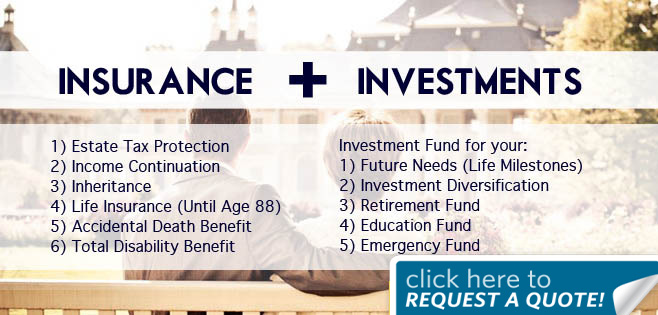

– For my future family. When I got my first life insurance, I was still single but now I am already married with a child. My life insurance policy will take care of my young family if I ever I leave them too soon (hope not). In addition to my life insurance which I got 3 years ago, I got another variable universal life (VUL) plan as a welcome gift for my baby. I want to make sure that he will at least get a college fund if I die or become permanently disabled. Since, VUL is investment-linked life insurance, the fund value of that plan has the potential to grow through the years especially if I put top ups (excess premium) on it. Right now, I am planning to get another VUL plan for my retirement and future expenses. With inflation, SSS retirement pension would not be enough in the future so I need to invest in a retirement plan that will grow through my working years.

-For critical diseases. My life insurance plans have riders for critical illness like cancer. This rider will provide money to fund my treatment if ever I get one (hopefully not again). I heard that cancer can wreck havoc to family finances even hearing news of families selling their properties and exhausting their retirement funds and savings just for cancer treatment. Years worth of savings will be exhausted for critical disease treatment without insurance.

-To force myself to save. With regular premium payment, I am forced to save in my life insurance plan. Banks don’t force us to save unlike life insurance companies. My first life insurance plan has already cash values which I can use if I need it. I met a teacher in our province few weeks ago with five life insurance policies, with premium payments automatically deducted from her salary. She’s so happy because some of her plans are already fully paid. Now, she just watch her savings grow with the insurance company.

How about you? What were your reasons why you bought life insurance? Share them in the comment box below.

For readers who have not yet bought life insurance, maybe my personal reasons will help motivate and inspire you to get life insurance for your family. It’s Time!

Latest posts by Raymund Camat (see all)

- How To Become A Sun Life Financial Advisor - December 19, 2021

- Importance of Emergency Fund During a Pandemic (COVID-19) - March 18, 2020

- The Importance of Having an Emergency Fund - September 8, 2019

- Whole Life Critical Illness Insurance Plan – 100 Critical Illnesses Covered Up To Age 100 - September 8, 2019

- Benefits of Having a Life Insurance Plan with Investment - September 8, 2019

Leave a Reply