College education is getting expensive year after year making it very difficult for Filipino parents to send their children to college.

College education is getting expensive year after year making it very difficult for Filipino parents to send their children to college.

Private college education can be just a dream for many parents and their children with popular universities such as Ateneo, La Salle and UST charging 6 digit annual tuition fees.

Many parents want to provide the best college education for their children because they know that a college diploma will provide better opportunities for their children. But with the expensive cost of college education, many parents may force their children to postpone college.

Proper educational planning should be done as early as a child is born. You may ask, why so early? It is because if you start early, you have more time to save up for college and more time for your investment to grow in a rate higher than the current inflation rate. (Inflation is defined as sustained increase in the general price level of goods and services in an economy over a period of time. Example: College tuition & miscellaneous fees increasing every academic year)

It is not enough that you save the college fund in the bank because inflation will eat its value over time. Regular savings account give less than 1% interest rate while time deposits give less than 2% interest rate. Earnings from bank interest is also subjected with 20% withholding tax. Your college savings should catch up with inflation.

Inflation rate is at average 3-6 percent higher than what your bank is giving you for your deposit. If a private university is charging 3000/unit right now, do not expect the same tuition rate when your child enroll to the same university in the future. Inflation is one of the factors why tuition fees increase over time.

THE SOLUTION

The life insurance company that I represent is offering this 5 year to pay Variable Universal Life (VUL) plan that can answer your need for funding your child’s college education. It is a life insurance plan with investment feature. It enhances your money’s growth potential to fund future needs like education through its investment earnings.

This VUL insurance policy is payable for at least 5 years. You will be the one to choose what investment fund you will put the college fund of your child. Currently, there are 5 funds to choose from and these are managed actively and prudently by top-notch investment professionals.

In order for you to easily understand this VUL plan, I created a sample proposal for a healthy Filipino father, 25 years old, with a new born son and non-smoker.

The Solution: 5 Year To Pay VUL Plan

VUL Plan with Face Amount 200,000 Proposal for Mr. Juan Dela Cruz, 25, Male, Non-smoker

Annual Investment: 32,128 pesos/year for 5 years (2,677 pesos/month or 89 pesos/day) (160,640 pesos total investment in 5 years)

Face Amount: 200,000 pesos – this is the value in which life insurance benefits are based on.

LIFE INSURANCE PROTECTION

The VUL plan is a life insurance product. Upon the death of the insured, Mr Juan Dela Cruz, the life insurance company will provide a guaranteed lump sum amount of 200% of the face amount or 400,000 pesos to the beneficiaries of Mr Juan Dela Cruz. The 400,000 pesos is considered the death benefit. The investment value or fund value (the college fund) accumulated will also be provided to the beneficiaries.

In case of accidental death of Mr. Juan dela Cruz, the life insurance company will provide additional 200,000 pesos to his beneficiaries for a total death benefit of 600,000 pesos PLUS the fund value (investment) accumulated. The additional 200,000 pesos death benefit is from the Accidental Death Benefit rider attached to the the plan.

In case of total and continuous disability due to accident, the life insurance company will waive premium payment, in other words you don’t need to pay the premium but you are still fully covered. This benefit is provided by the Total Disability Benefit rider attached to the plan.

Now, you will ask: Raymund, is the life insurance necessary? Can I remove it? Answer: No, you cannot remove the life insurance component of the plan, in fact it is the basic benefit of the VUL plan. This plan is a variable universal life insurance plan providing lump sum amount to beneficiaries in case of death.

The life insurance protection that this plan provides is very important to the beneficiaries of Mr. Juan dela Cruz. Even if Mr. Juan Dela Cruz paid once (ex. initial quarter payment of 8032 pesos) and “something” happens to him, his beneficiaries will receive guaranteed 400,000 pesos. This money may not be so big but decent enough to help the widow move on. The widow may use the money to open a small business, pay debts, finance daily expenses, send children to school and so on.

If Mr. Dela Cruz thinks that 400,000 pesos is small, he could always increase the face amount of the plan to a higher one in order to increase the death benefit claim that his family will get in case “something” happens to him. Two hundred thousand pesos is by the way the smallest face amount of the VUL plan.

What if Mr dela Cruz decided just to put his 32,218 pesos in the bank instead of getting a VUL plan plan, what will happen in case “something” happens to him?

When he die, the bank will freeze his account and Mrs dela Cruz needs to pay the total estate tax of her spouse in order to withdraw the 32,218 pesos and all the cash deposits of Mr. Dela Cruz. If Mr. Dela Cruz just got the VUL plan, his wife will get from the life insurance company a guaranteed amount of 400,000 pesos, tax free if Mrs dela Cruz is an irrevocable beneficiary.

That’s the beauty of life insurance, your beneficiaries will get more than what you paid for in case of your early demise. It is particularly important when the insured is the bread winner of the family. Remember, when a bread winner dies, not only his physical body is lost but also his income. Life insurance is the answer for the lost income!

COLLEGE FUND

The best part of the VUL plan is the investment fund which will be used to finance the college education of your child. Big chunk of your yearly premium will be used to buy shares/units to an investment fund of your choice including Balanced Fund, Bond Fund, Equity Fund, Money Market Fund, Index Fund and MyFutureFund.

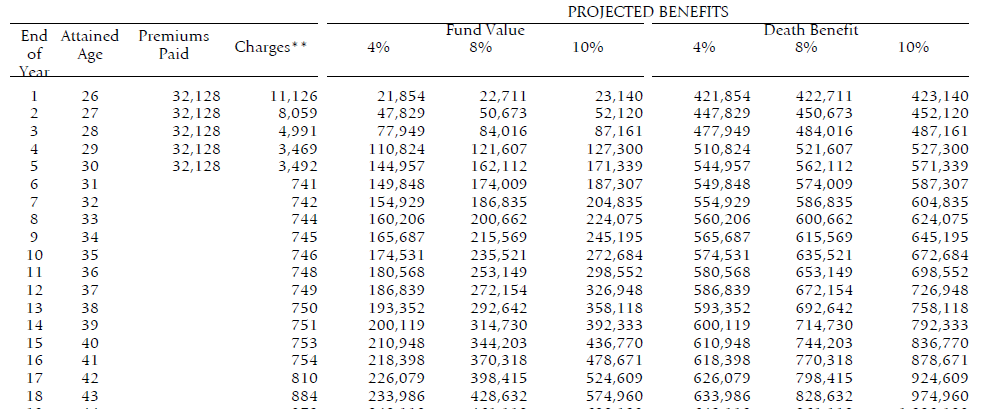

Below is a table taken from the VUL proposal for Mr Juan Dela Cruz (request your own proposal below this article). It shows important information about the VUL plan. Let us discuss them.

Premium Paid column = shows the amount paid each year, 32,128/year for 5 years (160,640 pesos total investment in 5 years)

Charges column = shows the charges (admin fees, management fees, premium charges, insurance charges) that will be deducted from your regular premium/payment

Death benefit column = the projected total death benefit; the sum of the 400,000 pesos guaranteed death benefit PLUS the fund value (college fund)

Fund Value 4%, 8%, 10% = these 3 columns show the projected fund value (college fund) each year. Take note that these are mere projections and not actual fund value in the future. Assuming that the new born son of Mr Juan Dela Cruz will start college after 18 years, how much is the projected college fund if the investment fund I chose gave me an average 10% annual return. According to the table, the fund value (college fund) would be 574,960 pesos which could be withdrawn as cash. Mr dela Cruz has the option to fully withdraw the money or he can do partial withdrawal each college year. Of course, college education in elite schools could be millions in the future so you need to get a higher plan if you wish to send your child to such schools. Take note also that if you have more than 1 child, you really need to get a bigger plan. But if you could not yet afford a higher plan, get the plan that suits your budget and increase your regular contribution as your income grows. It is better to have a small plan than without any plan at all, right?

WHAT IF MY CHILD WILL NOT USE IT?

If your child is a full scholar (free tuition fees with allowance), well that is super good and congratulations in advance for having such an excellent child. If your relatives will sponsor your kid, that’s even better because you don’t need to touch the fund value of your VUL plan. If this happens, use the college fund for your other children. If none of your children will use the college fund, then you can convert it to your retirement plan in which you will use the fund value when you reach retirement age. When Mr. Juan Dela Cruz, reaches age 60, the fund value could have grown to a projected value of 2.9 million pesos, assuming 10% average compounded annual return. This VUL plan is such a flexible plan as you could use it to any future financial need.

IS THE RETURN ON MY INVESTMENTS GUARANTEED?

You may ask me, Raymund you said that I am going to choose the investment fund where I will put the college fund of my child, this seems okay for me but I am quite afraid because we are talking about the future of my children, will you guarantee the returns on my investment?

I will answer: Returns are not guaranteed but based on historical experience, stocks and in particular equity funds tends to go up in value over time for investors who are prepared to buy and hold for a longer period of time. Note however, that past performance is not an indicator of future returns.

If you will ask investors or plan holders who started 10+ years ago, they will most likely give you a positive feedback with regards to their investment. These people knew how investment work and they used this knowledge to grow their money. Now, they are enjoying the benefits of investing in the long term. If you meet a person that could GUARANTEE to double your money in a dubious investment scheme, be careful because that could be a scam. Always talk to a licensed insurance or investment advisor when dealing with insurance and investment.

For OFWs: You can only open an account while in the Philippines to sign the documents and meet face to face an advisor. You cannot open an account while abroad as it is prohibited by law.

REQUEST PROPOSAL

Latest posts by Raymund Camat (see all)

- How To Become A Sun Life Financial Advisor - December 19, 2021

- Importance of Emergency Fund During a Pandemic (COVID-19) - March 18, 2020

- The Importance of Having an Emergency Fund - September 8, 2019

- Whole Life Critical Illness Insurance Plan – 100 Critical Illnesses Covered Up To Age 100 - September 8, 2019

- Benefits of Having a Life Insurance Plan with Investment - September 8, 2019

I Would recommend the Sun Maxilink Bright but if you are very consrvative, I would recommend Sun Dream Achiever.

can u pls send me this type of plan

Kindly send your name, age po sa raymund.camat@moneytalkph.com. Thanks

Yes continue pa rin ang life insurance. Mateterminate yung life insurance kapag nawithdra wmo na lahat ng fund value.

The plan terminated and the death benefit will be paid to the beneficiaries.