My recent client just got a VUL plan for herself. Variable Universal Life (VUL) plan is an insurance plan with investment/savings component. She wishes to give the investment value of the plan in the future as graduation gift for her beautiful and lovely daughter. She fully paid the entire 5 year plan in lump sum mode. She is afraid that she might spend the money to unnecessary things, that is why she intended to pay the full 5 years premium once.

Since the plan is already fully paid, she just need to wait for at least 10-15 years for her money to grow. Her money will be invested in an equity fund (Philippine stocks) which is professionally managed by life insurance company fund managers.

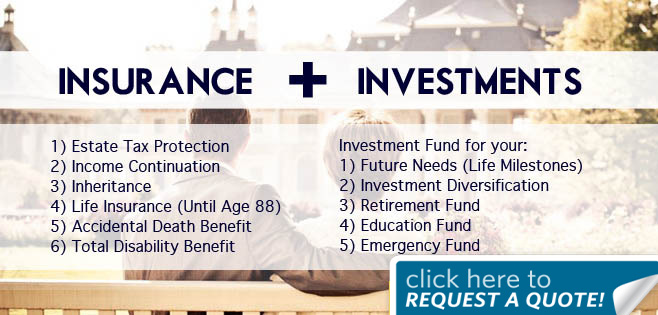

She has the option to add more money to the plan if she wants to. Adding more money to the fund will also increase the graduation gift to her daughter. The plan has also life insurance benefit – the insurance company will pay her family lump sum amount if she dies. The plan is a 5 year to pay VUL plan.

Parents usually get the this VUL plan as college plan for their kids but my client planned to use the plan as a graduation gift. The plan can also be used as a retirement plan. The investment value of the plan will grow into decent retirement fund. The plan is payable for 5 years shorter than the regular 10 year paying period of most insurance plans.

The client inspired me in many ways. First, instead of using the money to buy expensive material gifts for her child or pricey tours abroad, she used the money into something useful and meaningful. Many parents don’t have the same mindset like hers.

Many parents are having a hard time sending their kids to college, because they failed to plan many years ago. Some parents told me that they regret not preparing for their child’s college education as it is too late already to save; their kids are about to enter college and they don’t have enough savings nor emergency funds. The best time to start saving for college is when your child is 0-5 years old. Time is needed for money to grow.

I myself is also preparing for the college education of my kids. I regularly save and invest money for their future. The annual increase of tuition fees together with the inflation make college education expensive.

An annual tuition fee of 100,000 pesos will be equivalent to 500,000 pesos 15 years from now. This amount is scary and unbelievable but it is realistic considering the autonomy of schools to increase their tuition and miscellaneous fees. Compare the tuition fee few years ago to the tuition fee right now, you will be shocked how fast it has grown.

Planning ahead is one of the best things we could do to ensure the future of our children. It is our responsibility to provide our children with good education. A good education will definitely help them succeed in life.

Latest posts by Raymund Camat (see all)

- How To Become A Sun Life Financial Advisor - December 19, 2021

- Importance of Emergency Fund During a Pandemic (COVID-19) - March 18, 2020

- The Importance of Having an Emergency Fund - September 8, 2019

- Whole Life Critical Illness Insurance Plan – 100 Critical Illnesses Covered Up To Age 100 - September 8, 2019

- Benefits of Having a Life Insurance Plan with Investment - September 8, 2019

Leave a Reply