Condominium Care Advantage Insurance is a comprehensive insurance package specifically designed for condominium unit owners and tenants to protect their unit contents and improvements.

Condominium Care Advantage Insurance is a comprehensive insurance package specifically designed for condominium unit owners and tenants to protect their unit contents and improvements.

What can be covered under CCA?

- Contents

- Improvements

CCA Coverage

- Loss or Damage to Household Contents

- BPI/MS will pay for the loss or damage to household contents (includes but not limited to Furniture, Fixtures, Fittings, Electrical Appliances, Personal Effects EXCLUDING cash and jewelries) and/or improvements made by the insured up to the amount of sum insured caused by:

- Fire and/or lightning

- Earthquake

- Typhoon

- Flood

- Extended Peril Coverage

- Riot, Strike and Malicious Damage

- Broad Water Damage (with BOWTAP) (Deductible:Php20,000.00 for each and every loss)

- Sprinkler Leakage ( Deductible: Php5,000.00 for each every loss)

- BPI/MS will pay for the loss or damage to household contents (includes but not limited to Furniture, Fixtures, Fittings, Electrical Appliances, Personal Effects EXCLUDING cash and jewelries) and/or improvements made by the insured up to the amount of sum insured caused by:

- Loss or Damage to Works of Art, Paintings and Antiques

- Will pay for the loss or damage to Works of Arts, Paintings and Antiques up to a maximum of Php50,000.00 annual aggregate ( Deductible:Php2,500.00)

- Robbery and Burglary (excluding all mobile gadgets)

- Will pay for the loss of property due to robbery or burglary up to 10% of Contents Sum Insured maximum of Php500,000.00 (annual aggregate) whichever is lower (Deductible: 20% of claim amount)

- Loss Assessment

- Will cover the payment in the event that the owner of such unit is assessed by the association caused by peril(s) for which the Insured’s building is insured against up to a maximum of Php100,000.00 annual aggregate (Deductible: Php5,000.00)

- Plate Glass

- Will pay for accidental breakage of fixed glass/mirror up to a maximum of Php20,000.00 annual aggregate

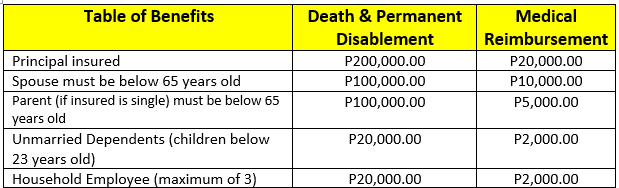

- Family personal Accident

- Will pay up to a maximum of Php200,000.00 annual aggregate for accidental death and permanent disablement from accidental means inside or outside the covered unit, including expenses for medical and surgical treatment for such injury, as well as Burial expense up to Php10,000.00 per person

- Comprehensive Personal Liability

- Will pay up to a maximum amount of Php200,000.00 annual aggregate for bodily injury and property damage caused to third parties inside the covered unit which includes medical and hospitalization bills, expenses for repair or replacement of any third party belongings damaged or destroyed, including legal fees to defend the insured in the event of a lawsuit

- Rental Income

- Will pay the actual monthly rental income up to a maximum of Php20,000.00 per month (maximum of 3 months) if property has been damages by an insured peril equivalent to a rental income

- Rental expenses

- Will pay up to a maximum of Php20,000.00 pr month (maximum of 3 months) if property has been damaged by an insured peril equivalent to a rental expense

- Removal of Debris

- Provides compensation for the effort of cleaning up to a 10% of Total Sum Insured (TSI) or Php30,000.00, whichever is lower

- Fire Fighting Expense

- Will pay up to a maximum of Php100,000.00 annual aggregate for firefighting expense reasonably incurred by the assured during a fire incident to prevent or minimize the extent of damage to the insured unit

- Temporary Removal (including transit)

- Will provide compensation to cover losses incurred by an insured peril in the policy, for property or items temporarily removed for repair, cleaning, renovation, or the similar purposes, as well as return of items to the original location up to a maximum of Php50,000.00 annual aggregate

- Household Helper Cover (maximum of 3 helpers)

- Will pay up to a maximum of Php5,000.00 annual aggregate for each household helper of the insured for any losses or damage to their property due to an insured peril

The following two tabs change content below.

Raymund F. Camat, CIS, REB, CWP®, CEPP® is a SEC-Certified Investment Solicitor (CIS), Certified Wealth Planner and Certified Estate Planner, Phils. He is also a licensed life insurance and mutual fund advisor for the number 1 life insurance company in the Philippines. He wants to educate the Filipino public on the importance of financial planning, investment planning, wealth planning and estate planning. He offers Personal and Family Wealth Planning to Filipinos from different generations. He has a bachelor's degree from the University of the Philippines. You can reach him at +639179698062 or email him at raymund.camat@moneytalkph.com. For OFWs, he also conduct online video consultation through Skype, Viber, Zoom or FB Video Call.

Latest posts by Raymund Camat (see all)

- How To Become A Sun Life Financial Advisor - December 19, 2021

- Importance of Emergency Fund During a Pandemic (COVID-19) - March 18, 2020

- The Importance of Having an Emergency Fund - September 8, 2019

- Whole Life Critical Illness Insurance Plan – 100 Critical Illnesses Covered Up To Age 100 - September 8, 2019

- Benefits of Having a Life Insurance Plan with Investment - September 8, 2019

Leave a Reply