Life insurance is a financial product that is not so popular among Filipinos because it talks about death which is a morbid topic to discuss. In fact, life insurance is one of hardest products to sell among Filipinos along with funeral plans. Compared to countries with advance economies in the world, the Philippines is among those with lowest percentages of the population with life insurance.

Life insurance in the Philippines is not as popular as high tech mobile phones and gadgets because the former is not a tangible product that would be readily enjoyed but an intangible product that promises compensation in the future if certain events will happen like death, accident, disability and critical illness. If you will ask someone to choose between life insurance and the latest model of iPhone or Samsung Galaxy phone – you know his/her answer already. We Filipinos face life uncertainties every day of our lives and life insurance (besides prayer) prepares us to these uncertainties.

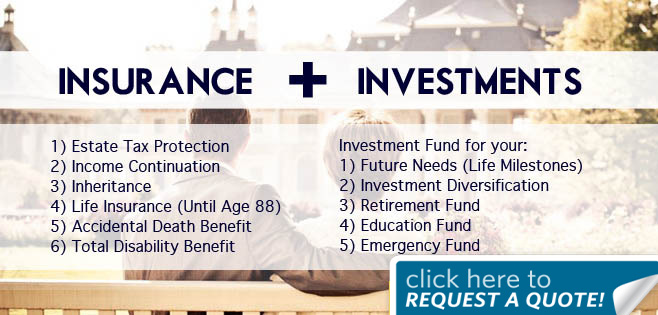

Life insurance has many benefits to every Filipino family. It helps protect the future of a family in the face of life uncertainties that hunt us every day. Let us discuss some of these benefits.

Income Replacement

Every day, hundreds of Filipino breadwinners die due to sickness or accidents. Besides the emotional and psychological impact of losing a love one, their families or dependents will also experience the financial impact.

Without the breadwinner’s salary, the dependents will face the problem of where to get money to pay the bills, to pay school bills, to buy food, to pay mortgage or to pay medical and funeral bills left. Financial problems could weaken the stability of the surviving family and could cause a lot more problems in the long term.

With the proceeds from a life insurance policy, the financial impact of a dead breadwinner will be reduced or be totally eliminated. The money from the life insurance policy will serve as replacement to the breadwinner’s lost income. The money can also be invested into a financial tool that will earn interest income sufficient to cover the monthly expenses of the family. In this way, the money will not easily run out but instead provide a continuous source of income for the family. But of course, the family should practice proper money management and financial planning so that the life insurance proceeds will not dry out too soon.

Educational Fund

Filipinos believe that the greatest inheritance that we can give to our families is education. But how can we provide education to our children if we are no longer here on earth to finance their education?

Premature death of parents or breadwinners makes the future of young children uncertain especially with the rising cost of education both in private and public colleges and universities. Even elementary and secondary educations are getting more expensive every year.

Fortunately, life insurance companies offer educational plans in the form of endowment and variable universal life (VUL) plans which will help finance your children’s college education. The good thing about these plans is that you can attach waiver of premium benefit rider. That is that premium payment is waived in the event that the payer (the parents) die or get disabled. In other words, the educational plan is already considered fully paid in the event of death or total permanent disability of the payer. With educational plan in their hands, children look forward to a brighter future.

Medical and Funeral Expenses (Final Expenses)

Of course, you wouldn’t want to left huge debt to your family so there should be adequate life insurance coverage that will pay final expenses such as medical and funeral expenses. Your family may be forced to use your savings or kids’ college fund just to finance these expenses. You wouldn’t want this to happen right? At least, you want to leave something for your family and not piling debts. Dying is expensive in the Philippines so it makes sense to be prepared financially.

Pay Estate Tax

It’s funny that the BIR or the government still hunts you down even in the afterlife. The tax agency requires your surviving family to pay estate tax or else your properties and other assets will not be distributed to them.

Yes, it is indeed unfair but our constitution protects the right of our government to tax us not only when we are alive but also after our death. To pay the tax, which is not cheap by the way, your heirs may be forced to sell a portion of your property, even below the market value, to pay the tax due.

Non payment of estate tax will result to hefty penalties which your heirs could not handle anymore and just forfeit their ownership of your estate. Would you be happy in the afterlife knowing that your most precious property that you worked hard to buy when you are alive is just handed down to the government for free and not to your surviving heirs?

Estate tax could be settled by your life insurance proceeds so that your properties will be wholly given to your heirs. It would be cool and great to leave something tangible to your family that could be passed from one generation to the next.

Retirement Fund

There are life insurance plans with savings or investment features for retirement. If you don’t die too soon (or live through old age), you still benefit from your life insurance policy in the form of maturity benefits, cash values and of course dividends.

The cash that you will get will be added to your other retirement fund sources such as SSS, GSIS or company-sponsored retirement plans. Since you will not be working in your retirement years, you should have enough money to at least put food in the table, pay medicines, medical bills, mortgage, and utility bills.

If you are planning to travel in your retirement years, well of course you need bigger retirement fund which you can build by saving or investing as early as you get your first pay check.

Emergency Fund

For whole life insurance plans, you can withdraw from the accumulated cash values and dividends to finance emergency expenses. You may also think a life insurance plan as a forced emergency savings just like your emergency cash in the bank. However, the cash value in a life insurance plan is not as easily accessible as an ATM savings account so you cannot easily touch it but only during emergencies.

The best time to get life insurance is NOW! You will never know what tomorrow brings so it is better to be prepared.

Latest posts by Raymund Camat (see all)

- How To Become A Sun Life Financial Advisor - December 19, 2021

- Importance of Emergency Fund During a Pandemic (COVID-19) - March 18, 2020

- The Importance of Having an Emergency Fund - September 8, 2019

- Whole Life Critical Illness Insurance Plan – 100 Critical Illnesses Covered Up To Age 100 - September 8, 2019

- Benefits of Having a Life Insurance Plan with Investment - September 8, 2019

Leave a Reply