Just like any Overseas Filipino Worker (OFW), we consider our seafarers or seamen as our modern heroes because of their dollar remittances that provide positive effects to our economy.

Not only that, Filipino seafarers are great providers to their families here in the Philippines – providing food in the family table, paying bills every month, sending their children to good schools, helping relatives in need, you name it!

Indeed, they are heroes to their own families. As overseas workers, they sacrifice a lot just to make sure that they provide a comfortable life and brighter future for their families. They risk their lives from pirates, sea storms, possible sea collisions and other sea accidents. They have one of the most dangerous jobs in the world, hence they deserved to be called modern heroes.

As a financial advisor, it saddens me when I hear seafarers who die early at a time that they are greatly needed by their respective families. The house is not yet fully paid; the children are still young without educational fund/plan; the sisters and brothers are not yet college graduates; there are still many debts to pay; housewives don’t know where to get money to put food in the table, pay bills and tuition fees, etc.; and many more financial problems that will arise.

All these problems will occur if a seafarer did not plan for his family’s future in case of his early death or disability like having a life insurance for himself and educational plan for his children. These financial instruments will help a seafarer’s family move on with their lives even after his death.

Although it is morbid to talk about death, it is dangerous without a plan for it. Every day, we are haunted with death, whatever we do, wherever we are, we just don’t know when will kamatayan take us away from this world.

The most tragic thing about dying is that our dreams for our family dies with us, if we did not plan ahead. Trash away the bahala na attitude because it is really dangerous to have this attitude when we are taking into consideration the future of our own families. It is time to plan now my dear Filipino seafarers!

Real Life Story

One of my clients told me that the reason he wanted to get an educational plan for his children is because the death of his seaman neighbor has opened his eyes on the tragedy of dying without a solid financial plan.

His seaman neighbor is young with a successful career who just bought a new house and car for his family in an installment basis. His children are still young and studying. All of a sudden, the seaman died due to a vehicular accident. He has no life insurance and educational plans for his children.

Now, who will continuously pay the house? The car? Who will finance the education of his children? Who will pay debts? Would you expect that the wife will handle all the problems? Would you expect the relatives help the surviving family big time? Is the abuloy enough for a family without a breadwinner?

Along with buying a new house and car, the seafarer should have availed a life insurance or educational plan so that in the event that something happens to him, his family’s future is secured.

Life insurance proceeds will pay the house and the car and will put food to the table everyday. The proceeds can also be used by the wife to start a small business to augment the family’s income. The educational plan will help sure that the children will finish college.

My open-minded client would not want to be like his seafarer neighbor whose dreams for his family died with him. He wants to make sure that his daughter can go to an exclusive schools like Ateneo, U.P. or DLSU so that in the future she can easily find a good-paying and fulfilling job. He said that if he die early without a plan, his daughter may end up in a school with small reputation or may not go to college at all.

Before You Sail – Be Insured and Get Educational Plan Now!

Before you sail tomorrow, next week or next month, think about preparing ahead for your family’s brighter future. Write a “check” for your family’s future – be insured and get educational plan for your kids as soon as possible. As a hardworking Filipino seafarer, you deserve peace of mind that wherever you are in the planet, whatever happens in the dangerous sea, you are assured that your family’s future is being taking cared of by the life insurance company. You will be greatly remembered on how you take good care of your family even you are already in the hands of the heavenly Father.

Request a Life Insurance or Educational Plan Proposal Now!

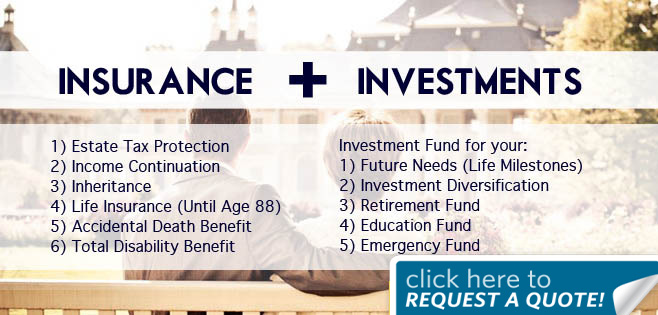

Yours truly is a licensed Financial Advisor. I can help you plan your family’s future. Let us talk about how much life insurance coverage you will need to make sure that your family is being taken care of financially even in your absence. Let us discuss how much educational fund your kids will need in the future. Let us also talk about your retirement – how much retirement fund you will need to have a comfortable retirement in the future. Would you like to retire early? It is possible!

You can request a proposal to me anytime and anywhere. You can text or call me at 09179698062, email me at raymund.camat@moneytalkph.com, or chat with me at FB messenger.

No one plans to fail. They just fail to plan.

Latest posts by Raymund Camat (see all)

- How To Become A Sun Life Financial Advisor - December 19, 2021

- Importance of Emergency Fund During a Pandemic (COVID-19) - March 18, 2020

- The Importance of Having an Emergency Fund - September 8, 2019

- Whole Life Critical Illness Insurance Plan – 100 Critical Illnesses Covered Up To Age 100 - September 8, 2019

- Benefits of Having a Life Insurance Plan with Investment - September 8, 2019

Sir,

Good morning i would like to inquire for my daughter for her educational plan. my salary is worth only $652. I’m a seafarer. I’m 29 yrs old.I am interested to have it a E-plan for her for her future.? she is now 7 yrs old. how much the starting payment of my child to avail the E-plan.thank you and more power to you.

Emailed you,

Good Day to you! I would like to inquire the best but affordable medical insurance for my parents. My Father is a retired seafarer and my mother is a housewife. What would you recommend that would cover their hospitalization and maintenance. Looking forward for your response. Thank You.