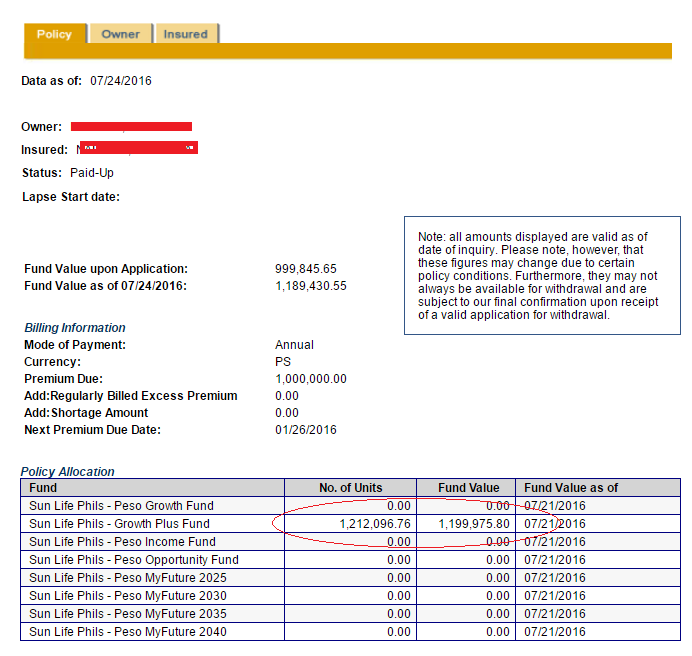

My client was very happy as her investment last January 26, 2016 worth 1 Million pesos has now grown to 1,199,975.80 pesos as of July 21, 2016. (Disclaimer: Value of investment changes every business day, may move up and down due to volatility, characteristic of equity investments).

She invested her money in a single-pay, peso-denominated, protection and savings product that offers an opportunity for faster accumulation of fund value because it has no initial charges. It provides life insurance coverage (125% of Investment) to the insured PLUS the flexibility to choose where her money will be invested (equity fund, bond fund, balanced fund, index fund, growth fund, growth plus fund), depending on her risk appetite and financial objectives, to maximize your money’s earning potential.

In just 6 months, my client’s money has “paper gain” of almost 200,000 pesos. It is called “paper gain” as she did not yet withdraw the earning as of this time. If she have withdrawn the earning, the total “realized” earning would be 199,975.80 less 5% early withdrawal penalty & 0.6% VAT = 188,777 pesos. The 5% early withdrawal penalty is being charged if a client withdraws her money in less than 5 years; this withdrawal penalty decreases every year for 5 years and after 5 years no more charges imposed. The 0.6% VAT (computed as 12% of the 5% early withdrawal penalty) is mandated by the BIR.

Beating Time Deposit Rate

If my client invested her money in time deposit for 6 months, her 1 Million pesos may have earned only 1% or 10,000 pesos less 20% withholding tax = 8,000 pesos. It would probably take more than a decade for her 1 Million pesos to earn the 188K pesos gain of her single pay investment. My client told me that she will not be needing the 1 Million pesos in the next 5 years so it would not be wise to put it in a time deposit account where the value of her money is being eaten by inflation (the decrease in the purchasing power of peso).

Equity Fund

My client decided to put 100% of her money to an equity fund, a fund that aims to maximize returns through a combination of long-term capital growth and current income by investing in a portfolio of high-quality Philippine listed equity and equity-linked securities that yield dividends. Examples of high-quality Philippine listed equities are PLDT, SM Development Corporation, Ayala Land and BDO. These companies are stable and profitable.

Benefits of Investing in this Equity Fund

- Better Possible Returns. Unlike traditional savings with fixed interest rates, investments in dividend-paying equity instruments provide higher potential earnings, as the dividends the Fund receives may augment stock price appreciation or serve to limit downside risk.

- Professional Portfolio Management. Clients have the insurance company’s investment experience, commitment and research capabilities working for them.

- Liquidity. Equity fund units can be redeemed on any business day (Subject to company guidelines.).

- Diversification. Client’s investment is placed in a wide selection of dividend-paying stocks depending on the optimal number of stocks as required by the strategy, reducing over-all risk.

- Active Fund Management. The fund adopts an Active Portfolio Management Strategy that gives flexibility for the Fund to swiftly reallocate assets within dividend-paying equity securities and be exposed to high-quality and financially-stable companies.

Estate Tax Avoidance

My client understands that when she die all her assets will be frozen by the government. Her beneficiaries need to pay estate tax (6%) to the BIR before they could transfer the assets to their hands.

My client wanted her one million pesos not to be subjected with estate tax. I recommended to set her children as irrevocable beneficiaries so that her money will be received by his sons without estate tax once she died. This tax avoidance scheme is legal under the Insurance Code of the Philippines.

The only disadvantage of setting her children as irrevocable beneficiaries on her single Pay VUL plan is that she cannot withdraw her money without her children’s consent (signatures) because irrevocable beneficiaries are already considered “part owners” of the policy. My client doesn’t mind.

Invest in Single Pay VUL

You too can earn profit the same with my client by investing with single pay VUL. The lowest single pay investment is 250,000 pesos. No medical exam, health restrictions and age limit to apply for this plan under the General Insurability Offer (GIO). Talk to a financial advisor today and begin investing. You may contact me at 09179698062 or email me at raymund.camat@moneytalkph.com

DISCLAIMER: The investment risks, including but not limited to credit risk, mark-to-market risk, taxation risk, regulatory risk, currency risk, interest risk, liquidity risk and default risk associated with this product are to be borne solely by the policy owner.

Latest posts by Raymund Camat (see all)

- How To Become A Sun Life Financial Advisor - December 19, 2021

- Importance of Emergency Fund During a Pandemic (COVID-19) - March 18, 2020

- The Importance of Having an Emergency Fund - September 8, 2019

- Whole Life Critical Illness Insurance Plan – 100 Critical Illnesses Covered Up To Age 100 - September 8, 2019

- Benefits of Having a Life Insurance Plan with Investment - September 8, 2019

Leave a Reply