This post was originally posted at Pesos and Sense Facebook Page: https://www.facebook.com/pesosenseph/photos/a.239539652897459/1106642922853790/?type=3&theater I wish you will be inspired to save up!

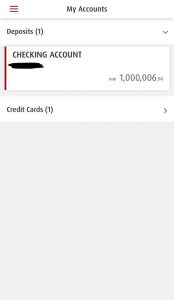

Hello! Please keep my identity private! Just wanna share my #iponstory. Today, I have reached my financial goal 4 months earlier than my target date. I want to be a Millionaire by the age of 30. I know it’s not that impressive since madaming tao na naka reach ng ganito at younger age.

Hello! Please keep my identity private! Just wanna share my #iponstory. Today, I have reached my financial goal 4 months earlier than my target date. I want to be a Millionaire by the age of 30. I know it’s not that impressive since madaming tao na naka reach ng ganito at younger age.

I started saving when I was 23. That time, sobrang bwisit ko sa boss ko and I really wanted to quit my job but I couldn’t because I am broke. Ang sama sa pakiramdam pumasok sa trabaho na hindi mo gusto at lunukin lahat ng mga paandar ng boss mo just because you can’t afford to quit. You know, #notsorichkidproblems.

Since then, I promised my self, mag iipon ako at mag iinvest sa sarili ko para anytime na di ko na matiis yun boss ko, pwede ako lumayas anytime. As in ang gusto ko, yun kaya mag wa-walk out. Like, “I quit. Bye.” Hahahahah!

So nag loan ako sa SSS. 14k yun first loan ko at yun ang pinang open ko ng checking + ATM account but di ko kinuha yun ATM that time kasi ayoko ma tempt na anytime pwede ko i withdraw yun money ko sa bank. I promised my self since then that I will always pay my self first. So pag kuha ng sweldo, ipon muna bago gastos. Nag umpisa ako sa pa 1k, 2k per cut off hanggang dumating yun time na kaya ko na i save yun half ng sweldo ko.

I took up MBA as part of my investment sa sarili ko. Kelangan ko pagandahin ang credentials ko para maka kuha ako ng magandang work. Sariling sikap, wala akong hiningi kahit piso from anybody kasi gusto ko pag natapos ko yun Masters ko, masasabi ko taas noo na I did it all by my self. But thank you DLSU sa scholarship kahit kelangan ko iyakan ng very light ang dean para bigyan ako ng scholarship.

Ang sosyal pa ng mga classmate ko. Sobrang OP ako kasi de kotse sila lahat. Ako naglalakad at nag LRT lang that time. Why not? Eventually, it all paid off.

Hindi naman ako puro ipon ng ipon. I also made sure that I was able to give back to my family. My dad passed away when I was 22 and I am sad na hindi nya na ako na abutan sa part ng life ko na pwede ko na sya ilibre anywhere nya gusto. That’s why, I made sure that I save some of my salary and incentives sa travel fund so I can treat my Mom and my brother out of the country once a year. And nun na promote ako ulit, I promised my mom na papa aralin ko sa law school ang bunso kong kapatid.

I could’ve reached this million earlier but I wouldn’t have it any other way. I believe that the Heavens will bless me more if I become a blessing to others too.

Kaya for the young professionals, the moment that you earn your own money — pay your self and invest in your self first. Start up a bank account then save up for your emergency fund then get an insurance then start to invest. Most specially, share your blessings to others and it will all come back to you a thousand fold.

P.S – You can use yor 13th month pay to start up and open that bank account. Wag nyo na muna kunin ang ATM until such time you build that discipline of not withdrawing your money.

My suggestion to him:

I suggest he invests some of that money to bonds, stocks or mutual funds as these financial instruments provide better returns than what the bank can offer.

Latest posts by Raymund Camat (see all)

- How To Become A Sun Life Financial Advisor - December 19, 2021

- Importance of Emergency Fund During a Pandemic (COVID-19) - March 18, 2020

- The Importance of Having an Emergency Fund - September 8, 2019

- Whole Life Critical Illness Insurance Plan – 100 Critical Illnesses Covered Up To Age 100 - September 8, 2019

- Benefits of Having a Life Insurance Plan with Investment - September 8, 2019

Leave a Reply