Fire incidents are regular headlines in tabloids, newspapers and national television in our country. Many lives are lost because of fire and many properties are turned into ashes in a span of few hours. Building and fire codes are not strictly implemented in our country that is why the incidence of fire is high especially in metropolitan areas like Manila.

Fire incidents are regular headlines in tabloids, newspapers and national television in our country. Many lives are lost because of fire and many properties are turned into ashes in a span of few hours. Building and fire codes are not strictly implemented in our country that is why the incidence of fire is high especially in metropolitan areas like Manila.

Although fire incidents are common in the Philippines, majority of families and business owners don’t know how to insure their properties in case of fire. If you ask them why they don’t have fire insurance policy, they commonly answer that it is just an expense and they certainly don’t need it. They believe that fire insurance is expensive and unnecessary. But they are wrong because fire insurance is not that expensive contrary to what many people believe.

Many people also believe that they are careful enough to prevent fire from happening. In reality, fire can happen to any house or to any building no matter how careful we are. Fire is a risk that everyone of us should face. Getting fire insurance is one way of facing the risk of fire. If we insure our home, buildings and properties from fire, we could get a lump sum amount of money from insurers to repair or build what we have lost.

Some people are just not educated about insurance or they have wrong notions about insurance. This is the reason why they don’t have insurance for their properties against fire. Insurance companies should do information dissemination drive educating the public on the importance of getting fire insurance.

Families can get fire insurance for their houses. Condo owners or lessee can insure the contents of their units. Building owners can get fire insurance for their building. Business owners can insure their stocks or supplies and even equipment and machinery. Fire insurance is also applicable for factories and manufacturing plants. (We have special package for condominium fire insurance, click here to learn more.)

Fire insurance gives us incomparable peace of mind. If you are a father, you have a peace of mind that when fire turns your house into ashes, an insurance company will help you recover from the disaster by providing you the amount they promised to pay in the fire insurance contract. The insurance claim will help provide your family a new home after a fire. Being homeless is the last thing we don’t want to happen to our family so fire insurance is highly important. Don’t consider it just an unnecessary expense but an important expense for your family’s welfare.

If you are a businessman, you have the peace of mind that when your stocks, products, equipment and machinery are turned into ashes by fire, the amount you can claim from the insurance company will help you start over again. Fire insurance is one way of protecting your business, the source of your income. Going bankrupt after the fire is the last worst thing that could happen to you. By shelling out a very small portion of your profit to buy fire insurance, you have the peace of mind that whatever happens, your business will continue.

If you own a building or establishment, you can also get a fire insurance policy for it. The insurance claim will help you repair building damages due to fire. If you failed to get fire insurance, you may need big amount of money to fix fire-damaged parts of your building. If your building is not restored to its original appearance, some of your tenants may go elsewhere and you lose your regular rental income.

Affordability of Fire Insurance

When I first hear the cost of fire insurance, I was shocked because it broke the long time notion of mine that fire insurance is expensive. I can get 1 Million standard fire and lighting insurance for our house for less than 2000 pesos. That is just 166/month for peace of mind; the price of a Starbucks frappucino. For additional premium, I can avail the following additional coverage:

- Extended Coverage (Explosion, Smoke Damage, Vehicle Impact and Falling Aircraft)

- Riots and Strikes

- Malicious damage caused by a Third Party (e.g. a bystander intentionally hitting your window with a stone

- Robbery

- Earthquake Fire / Earthquake Shock

- Flood and Typhoon

Properties that can be covered:

- Building/s whether occupied as residential, commercial, industrial or used for warehousing purposes

- Household contents

- Building / Leasehold improvement

- Machinery

- Equipment

- Stocks

Best Fire Insurance Company

BPI/MS Insurance Corporation is one of the leading providers of fire insurance policies to homeowners, businesses and corporations. It is one of the most trusted non-life insurance companies in the Philippines today. The company carries the name of BPI , the oldest bank in the Philippines and Mitsui Sumitomo, a leading insurance company in Japan and Asia.

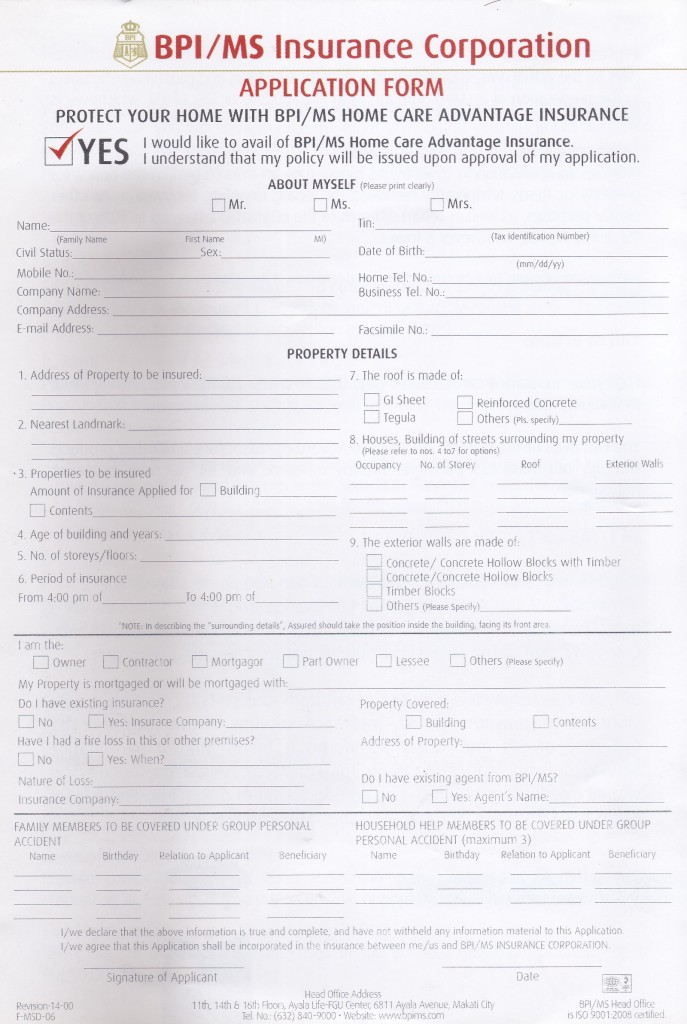

If you need fire insurance for your house, business or properties, do not hesitate to contact me. I am licensed agent of BPI/MS Insurance Corporation. I will be happy to assist you in getting fire insurance policy for your properties. I will help you get the best rates on fire insurance. Our company has a good reputation in terms of paying claims so you will never go wrong in choosing our company as your insurer.

Request a quote below. Please gives us 5-7 business days to process your request for a quote. Please provide all necessary information for faster processing. Incomplete details will not be processed fast.

Special Package for Home Owners: Home Care Advantage

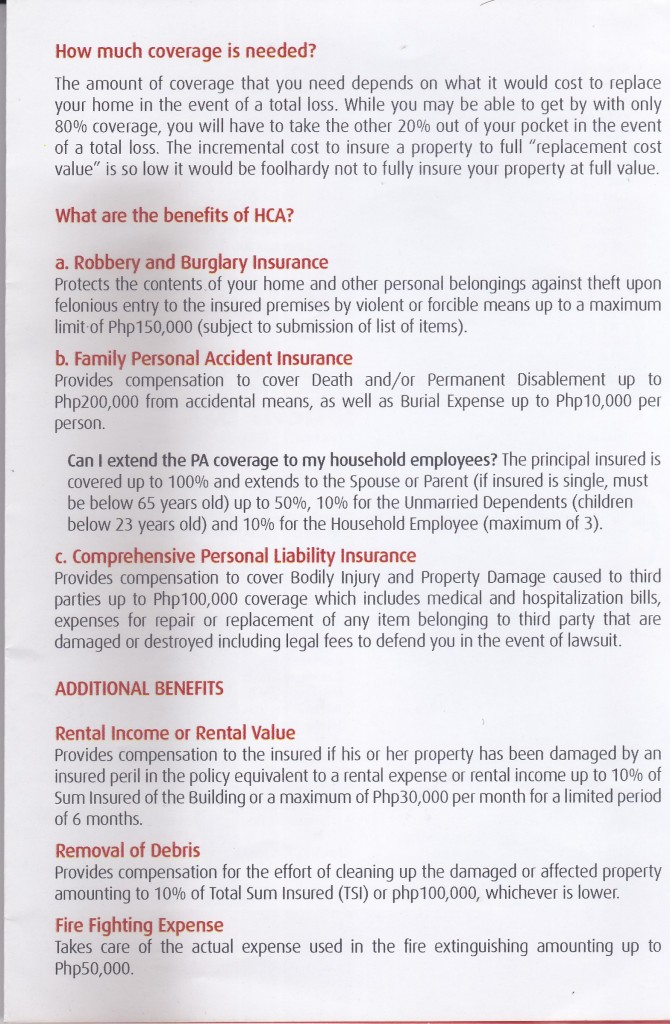

There is more to fire insurance coverage for your beloved home. You can add other perils or risks such as earthquake, typhoon, flood, malicious damage, landslide and water damage. With Home Care Advantage, you can protect your home with just one policy contract. You don’t need to get separate contracts. For quotation, please fill out the form above and note in the “message section” that you are interested with the home care advantage package.

Latest posts by Raymund Camat (see all)

- How To Become A Sun Life Financial Advisor - December 19, 2021

- Importance of Emergency Fund During a Pandemic (COVID-19) - March 18, 2020

- The Importance of Having an Emergency Fund - September 8, 2019

- Whole Life Critical Illness Insurance Plan – 100 Critical Illnesses Covered Up To Age 100 - September 8, 2019

- Benefits of Having a Life Insurance Plan with Investment - September 8, 2019

I am interested to insure my house from fire and earthquake. can you please send me a sample quotation if for example the property is worth P500,00.00 located in

Quezon City.