When my son was born into this world, I immediately doubled my life insurance policy coverage because I want to make sure that whatever “happens” to me, he will have a better future. I also opened a mutual fund account and a VUL policy for his college education. I will do everything to secure the future of my son. The reason I am working very hard is to provide my son a better and brighter future. I believe that every responsible Filipino father only wish for a better future for his children.

When my son was born into this world, I immediately doubled my life insurance policy coverage because I want to make sure that whatever “happens” to me, he will have a better future. I also opened a mutual fund account and a VUL policy for his college education. I will do everything to secure the future of my son. The reason I am working very hard is to provide my son a better and brighter future. I believe that every responsible Filipino father only wish for a better future for his children.

Recently, I helped a client (young and successful civil engineer) secure the future of his son with special needs (minor autism). I helped him acquire a life insurance policy with 2 Million pesos death benefit and 2 Million critical illness benefit (cancer, stroke, etc). I learned from him that it is really tough to be a parent of a child with special needs. He realized that it would be difficult for his wife to raise their child as a single mother if he die especially if money would be a major problem. His wife is working as a full time mom right now. With this realization, he decided to get a life insurance policy; thankfully he found me through this blog.

I told him that a 2 Million life insurance policy would not be enough if we consider all the expenses involved in raising a kid with special needs in addition to the rising cost of daily living (utilities, food, clothing, rent, etc). However, he said that it is what he can afford right now and promised me that he will increase his coverage in the future. I will surely motivate him to secure additional coverage in the future because I think it is my responsibility to make sure that my clients like him have adequate life insurance overages. There are many instances in the past that widows complain to their insurance advisors why they did not convince their husbands to get higher coverage. I don’t want to receive similar complain in the future.

When a father die, his income also die. There should be a replacement to that income or a financial disaster will happen to the family. The surviving spouse will have the responsibility to raise the kids alone. If she is unemployed, the problem will get worse. She may need to sell some of their properties or she may need to borrow until debt piles up.

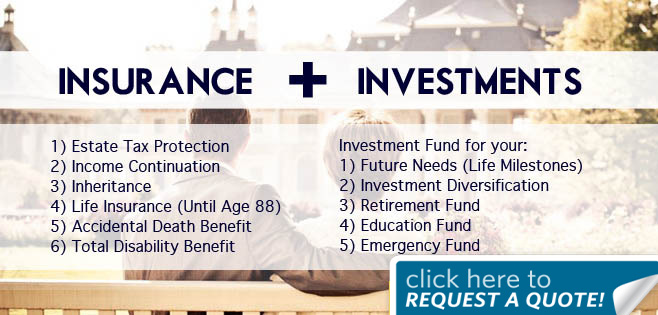

If the breadwinner has a life insurance policy, the spouse will have money to pay funeral expenses, existing debts/loans, estate taxes, utilities, college tuition and miscellaneous fees and more importantly the daily cost of living. Having a small insurance coverage is better than having none. One friend was able to save their house from foreclosure with the insurance proceeds she received after the death of her husband. Good thing his brother , a life insurance agent, secured a life insurance policy for his husband.

My engineer client made one of his best decisions to date: getting a life insurance policy to secure the future of his spouse and son. Truly, he is a loving and responsible father. I wish many Filipino fathers out there will follow him. Cheers to him!

Latest posts by Raymund Camat (see all)

- How To Become A Sun Life Financial Advisor - December 19, 2021

- Importance of Emergency Fund During a Pandemic (COVID-19) - March 18, 2020

- The Importance of Having an Emergency Fund - September 8, 2019

- Whole Life Critical Illness Insurance Plan – 100 Critical Illnesses Covered Up To Age 100 - September 8, 2019

- Benefits of Having a Life Insurance Plan with Investment - September 8, 2019

Leave a Reply