Seeing my grandparents reaching their 80s quite amazed me because they were able to live 8 decades which I think is a superb biological achievement.

I believe that with my generation, very few will be able to reach 80 years old like my grandparents did, considering all the unhealthy food we eat, the polluted air we breathe and the daily stressors of life we always face.

While I am happy that my grandparents have lived this long I feel sadness in my heart that they are unprepared for retirement. Instead of enjoying their remaining years in this world, they are still working to survive, to put food in the table, to pay electricity, to buy medicine, etc.

They could not depend to their nine children because all of them have families of their own already and not financially well off. I am just glad that my grandmother is still strong to shop in the market and buy groceries for her small sari-sari store.

I know she’s tired already and she has no choice because my grandfather could not help her anymore because of his condition: heart problem, weak vision, hearing problem and general weakness.

I always hear financial and health complaints from my grandparents whenever I have a chance to talk to them. I give money to both of them sometimes but not much because I have many financial responsibilities in my hand already: having my own family to provide for and still sending my own siblings to college. How I wish the dear Lord provide me more with blessings so that I can share more to my aged grandparents.

Because retirement planning is an alien phrase in the past (and probably at present), I could not totally blame my grandparents for their lack of retirement preparedness. They were not professionals but just farmers back then and putting food in the table for their big family is the top priority instead of saving for retirement.

I guess they don’t have any idea of retirement planning or they just think that retirement planning is for the rich people only. Even their kids including my father don’t know anything about retirement or even care about it.

Thankfully, just few months ago I told him and my mother that opening SSS account is not only for employees but also for farmers as well (my parents are farmers) and it is not yet too late for them to have something to look for retirement.

Although SSS is not enough for retirement, it is still better to have one than nothing at all. They love the idea of being pensioners someday but I just wish they would not be shocked of how little they are going to receive. Actually, my parents are already in their 50s so it is a little bit late for them to get SSS but not too late to have one.

Many of us today, especially the younger generation, don’t think of retirement planning because we think that it is too early to plan retirement. We think spending and enjoying our money is the best thing to do while we are young.

We want to enjoy life because we think we deserve it. It is not wrong to enjoy life with our hard earned money but we should also prepare for the future.

We should set a side portion of our income for future needs or for retirement. It is never too early to plan retirement. The earlier we start the better because money grows through time.

Didn’t you wonder why we were required by the government to start contributing to SSS/GSIS as early as we start working?

It is because it needs time for our money to grow. SSS/GSIS will invest our money to different investment channels in order to grow. SSS/GSIS does not just put our contributions in the bank, they invest it to grow. Their investment earning is what they use to support millions of pensioners today and to finance our SSS benefits.

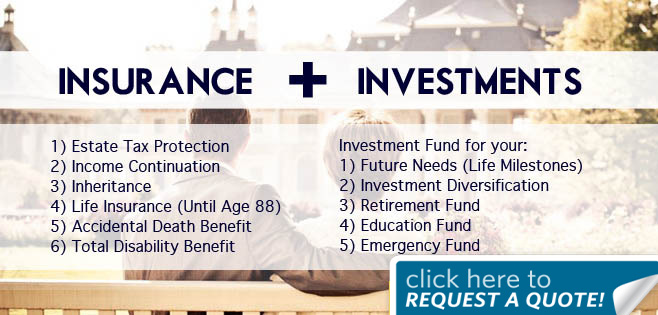

Besides contributing to SSS, we could also start investing in mutual funds and in the stock market. For a minimum initial investment of 1000 pesos we could already open an account in a stock broker or mutual fund.

Make it a habit investing in stocks or mutual funds regularly and through time you watch your investments grow. The current year on year return of Sun Life Prosperity Equity fund (a mutual fund) as of writing time is 43.76%, higher than the less than 1-2% interest from the bank.

So if you invested 100,000 pesos on Sun Life Equity fund 365 days ago, your money could have earned 43,760 pesos already. Not bad right? Imagine your retirement wealth if you made it a hobby investing in stocks and mutual funds at age 21. I am sure, you will not end like my grandparents who are still working on their 80s.

Buying expensive gadgets and things that you don’t need is a waste of money. They depreciate in value so fast unlike mutual fund and stock investments that appreciate in value through time.

Make your money work harder for you by saving and investing. Money you don’t spend now (and you invest now) is money you will enjoy in the future. Do you want to retire poor? I know you don’t want to. Who does? Right? So save and invest now and if you don’t know where to start, just contact and I will help you out.

Latest posts by Raymund Camat (see all)

- How To Become A Sun Life Financial Advisor - December 19, 2021

- Importance of Emergency Fund During a Pandemic (COVID-19) - March 18, 2020

- The Importance of Having an Emergency Fund - September 8, 2019

- Whole Life Critical Illness Insurance Plan – 100 Critical Illnesses Covered Up To Age 100 - September 8, 2019

- Benefits of Having a Life Insurance Plan with Investment - September 8, 2019

I believe it is really high time for Filipinos to rethink on how their retirement should be. If they want to have a better future, they should invest their money properly when they are still young.

I highly agree Ma’am 🙂

Is there investment here aside from retirement funds?