In a news article, I read about the story of a female retiree who was very excited to open a letter from SSS informing her about her monthly pension. She was very disappointed and dismayed with the amount of monthly pension she is going to receive from SSS after almost 40 years of continued membership. She thinks she deserves higher monthly pension because of the length of time she is contributing to the fund. One of the reasons she is dismayed is because she has no other sources of income for her retirement. From being excited to finally rest and enjoy her retirement years, she immediately felt fear and hopelessness as she cannot return back to the time she is actively working when there is opportunity to save up for retirement. She knows how small her monthly pension is that it will not be enough for food, medicine, utility bills and other expenses. She was able to send her kids to expensive schools but she failed to prepare for her retirement. She cannot just ask her kids to help her because they have their own families to take care already. In our culture, we are expected to help our parents on their senior years but I believe there is acute problem with this practice. Parents should not make their kids as retirement plans. They themselves should prepare for retirement. It might be harsh but it is the wise thing to do.

In a news article, I read about the story of a female retiree who was very excited to open a letter from SSS informing her about her monthly pension. She was very disappointed and dismayed with the amount of monthly pension she is going to receive from SSS after almost 40 years of continued membership. She thinks she deserves higher monthly pension because of the length of time she is contributing to the fund. One of the reasons she is dismayed is because she has no other sources of income for her retirement. From being excited to finally rest and enjoy her retirement years, she immediately felt fear and hopelessness as she cannot return back to the time she is actively working when there is opportunity to save up for retirement. She knows how small her monthly pension is that it will not be enough for food, medicine, utility bills and other expenses. She was able to send her kids to expensive schools but she failed to prepare for her retirement. She cannot just ask her kids to help her because they have their own families to take care already. In our culture, we are expected to help our parents on their senior years but I believe there is acute problem with this practice. Parents should not make their kids as retirement plans. They themselves should prepare for retirement. It might be harsh but it is the wise thing to do.

I also learned from reputable sources that the life span of SSS is not perpetual. The reason why SSS increased the monthly contribution in 2014 is to increase the lifespan of the fund but even with the increase of contribution the fund can only last until 2029 unless there would be new revenue sources for the agency or there would be higher monthly contribution rates to be imposed. There are politicians who just recommend the increase in monthly pensions for pensioners just to make “papogi or paganda” to the public without suggesting any reliable and sensible source of funding for the recommendation. The SSS cannot just recommend new contribution rates every few years because the members will get tired and angry. With the uncertainty of the lifespan of SSS, every paying member today should seriously plan his/her retirement by creating an alternative retirement fund.

There are many ways to prepare for retirement but my personal favorite is getting a Variable Life Insurance Plan or VUL to build retirement fund. I recommend this product to breadwinners, young professionals and OFWs who have no insurance yet or who are underinsured (not enough life insurance). Variable life insurance is a special type of life insurance plan with investment feature. For every payment, part of it will pay for the insurance and part of it will be invested in an investment fund of your choice: equity fund (stocks), balanced fund (stocks and bonds) and bond fund (bonds). Your money will grow over time with better returns than regular bank savings account. If you started young, you can retire a millionaire even if your payment is small. If you started late, you can still retire a millionaire if you are able to pay high premium for a VUL plan. Time and money are two important factors in investing as the video below shows:

There are many ways to prepare for retirement but my personal favorite is getting a Variable Life Insurance Plan or VUL to build retirement fund. I recommend this product to breadwinners, young professionals and OFWs who have no insurance yet or who are underinsured (not enough life insurance). Variable life insurance is a special type of life insurance plan with investment feature. For every payment, part of it will pay for the insurance and part of it will be invested in an investment fund of your choice: equity fund (stocks), balanced fund (stocks and bonds) and bond fund (bonds). Your money will grow over time with better returns than regular bank savings account. If you started young, you can retire a millionaire even if your payment is small. If you started late, you can still retire a millionaire if you are able to pay high premium for a VUL plan. Time and money are two important factors in investing as the video below shows:

You need to realize the importance of life insurance benefits of a VUL plan. It is a tool to generate wealth or replace your income after your demise. If there are people depending on your income, you should get a life insurance policy as soon as you can afford it. If you have small kids, the life insurance proceeds can help them finish their studies. You will lessen the burden of your spouse. Imagine raising your kids on her own with your lost income. If you have sisters and brothers who are depending on your income to finish their college studies, the life insurance proceeds can help them. This is the reason why I myself got my first life insurance policy when I was just 22 years old. I want my sisters to be able to finish college because I know that my parents are no longer capable to fully support their college education. Fortunately, I am still alive and they all graduated from college. Now, I have a family of my own and still feel that I am still underinsured with my growing family. I currently have 5 insurance policies that I got over the years. My company also included me in a group insurance policy. My wife has life insurance policies too. In fact, we are excited to get our next insurance policy soon if our income continues to grow. We have our VUL policies and we also have critical illness coverage. The educational plan of my child is a VUL policy. His cash gifts go strictly to his VUL policy.

Since I am working as insurance advisor for Sun Life of Canada, I can show you a short and simple illustration of our VUL plans. You can ask a proposal from me by filling out the form below this article. You can also ask other advisors from the top 10 life insurance companies in the Philippines.

Understanding VUL Video

Sun Maxilink Prime (10 Years To Pay)

Plan Name: Sun Maxilink Prime (Read my article about Sun Maxilink Prime here)

Face Amount: 500,000

Riders/Additional Benefits: Accidental Death Benefit and Total Disability Benefit

Number of Years to Pay: 10 Years

Name of Policy Owner & Insured: Juan Dela Cruz Chua

Age: 25

Gender: Male

Smoker: No

Annual Premium: 26,800 pesos (2233/month or 74/day)

Total Premium in 10 Years: 268,000 pesos

Investment Allocation: 100% Peso Equity Fund (Invested in Philippine Stocks)

Projected Retirement Fund at age 55: 2.065 Million Pesos (Assuming average 10% compounded annual growth rate)

Projected Retirement Fund at age 60: 3.306 Million Pesos (Assuming average 10% compounded annual growth rate)

Projected Retirement Fund at age 65: 5.288 Million Pesos (Assuming average 10% compounded annual growth rate)

*The projected retirement fund is not guaranteed but will be based on the actual performance of the investment fund. Since 2004, the average compounded annual growth rate of Sun Life Equity fund is 15%. Past return is not indicative of future returns.

Mr Juan Dela Cruz just need to save up 74 pesos a day for 10 years and he will retire a millionaire in the future. His total investment in 10 years is 268,000 pesos. Assuming he will never touch the money until he retires, he will get projected 3.306 Million pesos retirement fund from Sun Life in his 60th birthday. He has the option to withdraw all his money or just partially withdraw regularly to finance his daily needs. Seventy four pesos a day is do ‘able, all he need is discipline and determination to retire comfortably. If you can spend 140 pesos for a cup of premium coffee, why can’t you save up 74 pesos for comfortable retirement, right?

Let us not forget the insurance benefits of Sun Maxilink Prime. If Juan dies, his beneficiaries will receive 200% of the face amount (500K) or 1 Million pesos PLUS any accumulated investment. If death is due to accident, his beneficiaries will get additional 500K pesos from Sun Life. If he became disabled during the paying period, premium payment is waived. Even if Juan just paid the first quarter premium (6700 pesos) and something happened to him (died), his family will receive 1 Million pesos. One million may not be big enough in today’s cost of living but it would still be very helpful for his beneficiaries (e.g. spouse and children) to move on with their lives.

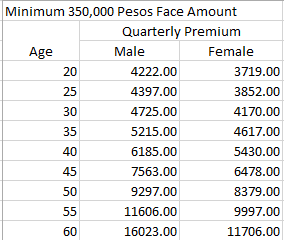

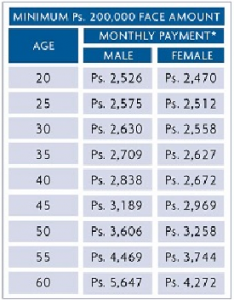

As you can see in the table, the younger the person is, the lower is his/her payment. You should not wait until you get older to get a life insurance policy because your premium will become more expensive. If you also delay getting insured, you may not be insurable in the future because of health reasons. If you have non insurable health conditions, even if you have money, you will not be issued a regular pay insurance policy.

Start investing for your retirement today. Request a free Sun Maxilink Prime proposal and personal meeting with me today. You can also reach me at 09179698062 or raymund.camat@sunlife.com.ph or raymund.camat@moneytalkph.com.

Sun Maxilink Bright

Plan Name: Sun Maxilink Bright (Read my article about Sun Maxilink Bright here)

Face Amount: 200,000 (Smallest face amount)

Riders/Additional Benefits: Accidental Death Benefit and Total Disability Benefit

Number of Years to Pay: 5 Years

Name of Policy Owner & Insured: Alden Richards

Age: 30

Gender: Male

Smoker: No

Annual Premium: 32,664 pesos (2722/month or 89/day)

Total Premium in 5 Years: 163,320 pesos

Investment Allocation: 100% Peso Equity Fund (Invested in Philippine Stocks)

Projected Retirement Fund at age 55: 1.138 Million Pesos (Assuming average 10% compounded annual growth rate)*

Projected Retirement Fund at age 60: 1.828 Million Pesos (Assuming average 10% compounded annual growth rate)*

Projected Retirement Fund at age 65: 2.934 Million Pesos (Assuming average 10% compounded annual growth rate)*

*The projected retirement fund is not guaranteed but will be based on the actual performance of the investment fund. Since 2004, the average compounded annual growth rate of Sun Life Equity fund is 15%. Past return is not indicative of future returns.

Sun Maxilink Bright is a 5 year to pay variable life insurance plan. This is popular among clients who wanted a shorter paying period but with good returns. In the illustration above, Mr Richards just need to save up 89 pesos per day for 5 years (total 5 year payment: 163,320 pesos) and he will retire with 1.828 Million pesos at age 60 or 2.934 Million pesos at age 65 assuming he had no missed payments and he had never touch his investment.

If Mr Aldens die, his family will receive 400K death benefit (200% of the 200K face amount). If death is due to accident, his family will receive additional 200K pesos from the Accidental Death Benefit Rider. If Mr Richards became totally disabled, Sun Life will shoulder his premium if his plan is not yet fully paid; this benefit is provided by the Total Disability Benefit rider of Sun Maxilink Bright. Take note that the total death benefit that Mr Richards’ family receive will include all the accumulated investments.

Premium Table

Start investing for your retirement today. Request a free Sun Maxilink Bright proposal and personal meeting with me today. You can also reach me at 09179698062 or raymund.camat@sunlife.com.ph or raymund.camat@moneytalkph.com.

Plan Name: Sun Maxilink One

Face Amount: 62,500 (Smallest face amount)

Riders/Additional Benefits: None

Number of Years to Pay: One time payment only (250,000 pesos)

Name of Policy Owner & Insured: Rayver Guttierrez

Age: 35

Gender: Male

Smoker: No

Annual Premium: None (One time payment of 250,000 only)

Investment Allocation: 100% Peso Growth Fund (Invested in Philippine Stocks)

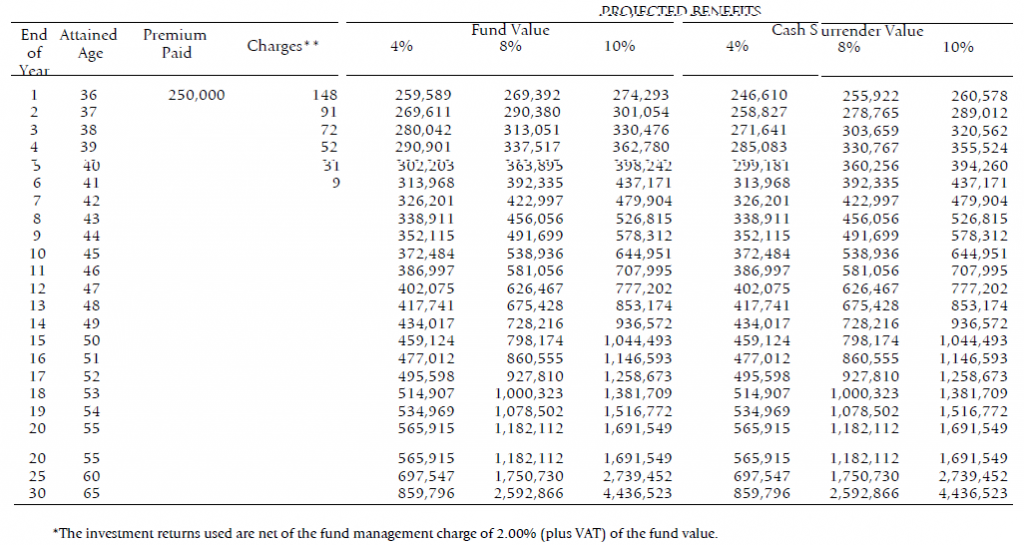

Projected Retirement Fund at age 50: 1.044 Million Pesos (Assuming average 10% compounded annual growth rate)*

Projected Retirement Fund at age 55: 1.691 Million Pesos (Assuming average 10% compounded annual growth rate)*

Projected Retirement Fund at age 60: 2.739 Million Pesos (Assuming average 10% compounded annual growth rate)*

Projected Retirement Fund at age 65: 4.436 Million Pesos (Assuming average 10% compounded annual growth rate)*

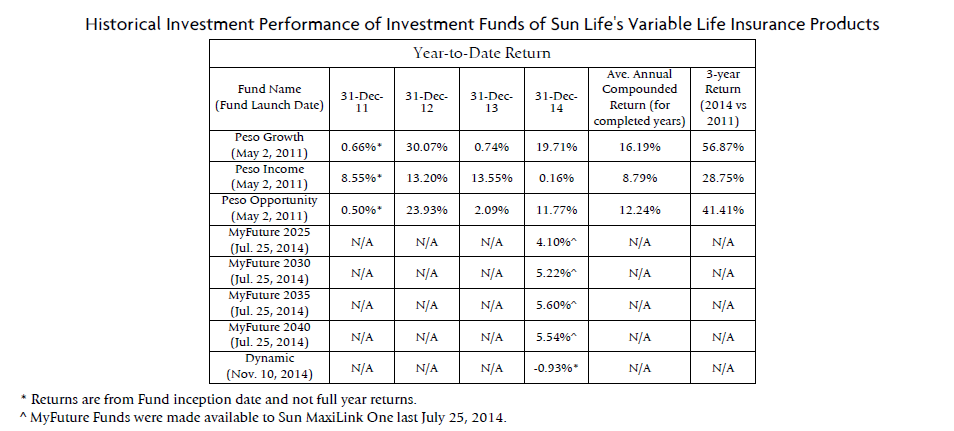

*The projected retirement fund is not guaranteed but will be based on the actual performance of the investment fund. Since 2011, the average compounded annual growth rate of Sun Life Peso Growth Fund is 16.19%. Past return is not indicative of future returns.

The Sun Maxilink One is different from Sun Maxilink Prime and Sun Maxilink Bright. In this plan your initially minimum investment is 250,000 pesos which you will only pay once. My own term for this is “one time big time investment” but the formal term is single pay variable life insurance.. For Sun Maxilink Bright, the minimum years to pay is 5 years and in Sun Maxilink Prime, the minimum number of years to pay is 10 years. Maxilink Bright and Prime are formally called regular pay variable life insurance. Sun Maxilink One has also lower life insurance coverage because it is “more” on investment. The death benefit is either the fund value or 125% of 250,000 (312,500), whichever is higher. For example, if Mr Gutierrez dies after 5 years, the projected death benefit (10%) is 398,242 pesos which is higher than the minimum death benefit of 312,500 pesos. The family of Mr Gutierrez will receive the 398,242 pesos from Sun Life.

The first table below shows the projected benefits in the future. The fund value columns show the projected fund values assuming the fund performs at 4%, 8% or 10% compounded annual growth rate. In reality, the annual growth rate varies; the 4,8,10% projections are for illustration purposes only. The second table below shows the historical performance of the investment funds that you can choose to put your money. Three year return is 56.8% (2014 versus 2011), better than bank savings interest rate. If you invested 1,000,000 pesos in 2011, the value could have been 1,560,000 pesos in 2014. With this return, you should be asking yourself now if it is in you best interest to let your money just sleep in the bank. Don’t let your money sleep in the bank, make it work harder for you by investing. The bank get richer with your deposits because they are able to loan it to people at higher interest rate (6-9%) while they only give you less than 1% interest rate. Invest in Sun Maxilink One now! You can invest a minimum of 250,000 pesos. The maximum amount you can invest is 120,000,000 pesos.

If you have 250,000+ now, invest it rather than letting it sleep in the bank or you use it to buy things that depreciate fast (ex. car, gadgets, etc.) Invest first before you buy material things that you may not need after all. What if you invest your 250K+ for retirement? Your 250K will grow up to 2.739 Million pesos at age 60, assuming 10% annual growth rate. If the investment fund you choose get a better return (15-20%), your retirement fund will be much higher. A 15-20% return is achievable in VUL, UITF, mutual fund or stocks.

The advantage of Maxilink One or any single pay VUL plan is that the death benefits can be received as tax free by your beneficiaries if you have declared them as your irrevocable beneficiaries. Mutual fund, bank savings, time deposit, UITF and stocks are all frozen the moment you die. Your family need to pay the estate tax to BIR before they can recover your frozen assets. It’s funny that even after death, BIR taxed us heavily. What if your family cannot pay your estate tax due to financial difficulties? Well, the BIR will impose penalty, surcharge, and interest against the estate tax. The tax free proceeds of your VUL plan will answer the immediate financial needs of your family after your death.

For Sun Maxilink One proposal, email me at raymund.camat@moneytalkph.com.

Latest posts by Raymund Camat (see all)

- How To Become A Sun Life Financial Advisor - December 19, 2021

- Importance of Emergency Fund During a Pandemic (COVID-19) - March 18, 2020

- The Importance of Having an Emergency Fund - September 8, 2019

- Whole Life Critical Illness Insurance Plan – 100 Critical Illnesses Covered Up To Age 100 - September 8, 2019

- Benefits of Having a Life Insurance Plan with Investment - September 8, 2019

Leave a Reply