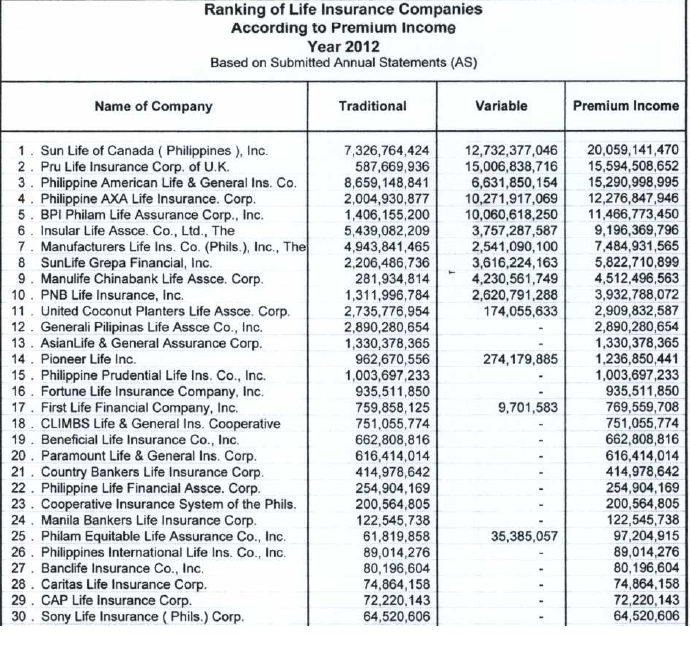

Besides from being a financial advisor, I am also a search marketing specialist that is why I am always intrigued on what Filipinos are searching online to reach this blog. I noticed that a lot of people are searching for the top life insurance companies in the Philippines for the year 2013. Although 2013 is finally over, the Insurance Commission has not yet released the ranking of life insurance companies for the year 2013. What data available right now is the 2012 ranking of life insurance companies on different categories such as premium income, assets, net worth and paid up capital. In this post, I would like to highlight the ranking of Philippine life insurance companies based on premium income. For your reference, last year, I wrote an article on the top 10 life insurance companies in the Philippines for 2011 based on premium income.

Investopedia.com defines premium income as the “revenue that is derived from premiums paid by customers.” This means the number 1 life insurance company in terms of premium income has collected the highest amount of premiums in the Philippines for the year 2012. This is a very good measurement on the performance of a given life insurance company. Strong marketing efforts and highly skilled insurance advisors contribute a lot on the revenue of each life insurance company. I noticed that major life insurance companies have aggressive marketing/branding efforts in the past year and these efforts have translated to higher revenues and more Filipinos being insured. More and more Filipinos are getting educated on the importance of life insurance and many of them actually get their own life insurance policies.

According to the Insurance Commissions’s website, this is the ranking of Philippine life insurance companies based on premium income for 2012. Canadian insurer Sun Life of Canada (Philippines), Inc. is again the number 1 life insurance company in terms of total premium income. This makes me proud as a financial advisor of Sun Life of Canada Philippines.

Sun Life beats the 2nd placer PRU Life UK with about 5 Billion pesos difference. In 2011, Sun Life beat 2nd placer Philam Life with just 300 million pesos difference. Unfortunately, last 2012 Philam Life’s ranking drop to number 4 and its rank was given to PRU Life. You could notice in the table that although Sun Life is number 1 in terms of total premium income, Philam Life is number 1 in premium income for traditional life insurance while the British insurer PRU Life UK is number 1 for variable life insurance (VUL). Pru Life remarkably jumped from rank 4 in 2011 to rank 2 in 2012. VUL is a combination of life insurance and investment in one plan; examples of VUL are Sun Life’s Sun Flexilink, Sun Maxilink Prime and Sun Maxilink. I am very proud of our very own Insular Life for being at rank 6 making it the biggest Filipino insurance company.

Sun Life has achieved 44% growth (5 billion pesos) in premium income on 2012. This is an astonishing growth for a life insurance company. All life insurance companies in the Philippines collected a total of P119,454,550,174 from policy holders. This looks big but according to studies only 1.1 percent of Filipinos have some form of life insurance. This is small percentage compared to other countries in the region.

I do believe that the ranking of Philippine Life Insurance companies is less important than the ability of these companies to fulfill the promises they have written in the policy contracts of millions of Filipino policy holders. They should be able to pay claims from policy holders and their beneficiaries. They should have enough reserve to pay present and future obligations to policy holders. They should be able to safe guard our hard earned money that we entrusted to them. We Filipinos deserve excellent service from these 30+ life insurance companies. We entrust the future of our families with them so they better do their job well.

Update:

Top 10 Life Insurance Companies in 2014

Related articles across this website:

Latest posts by Raymund Camat (see all)

- How To Become A Sun Life Financial Advisor - December 19, 2021

- Importance of Emergency Fund During a Pandemic (COVID-19) - March 18, 2020

- The Importance of Having an Emergency Fund - September 8, 2019

- Whole Life Critical Illness Insurance Plan – 100 Critical Illnesses Covered Up To Age 100 - September 8, 2019

- Benefits of Having a Life Insurance Plan with Investment - September 8, 2019

Dear Raymond:

It is easy to sign up for a life insurance plan with the desperate agent but when it comes to claiming, it becomes a difficult situation and delayed for the beneficiaries. This is true even with the major/popular life insurance companies. For myself, I limited my policy to cover for the estate tax and one year living expenses for the beneficiary. Too much value coverage may make my beneficiary greedy.

Chris